Loading

Get Attach To Form 40 Or Form 40nr

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ATTACH TO FORM 40 OR FORM 40NR online

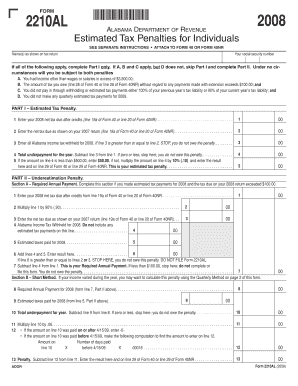

Filling out the ATTACH TO FORM 40 OR FORM 40NR is an important step for individuals addressing estimated tax penalties in Alabama. This guide aims to provide clear, step-by-step instructions to help users efficiently complete the form online with confidence.

Follow the steps to accurately complete your tax form.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Begin by entering your name as shown on your tax return in the designated field. Make sure the name is clear and matches the information on your official documents.

- Enter your social security number accurately in the appropriate field. Double-check to prevent any errors.

- If applicable, determine whether you need to complete Part I or Part II based on the criteria provided. Follow instructions provided on the form regarding income thresholds and previous year tax liabilities.

- In Part I, enter your 2008 net tax due after credits on line 1. Make sure this amount corresponds to the values from Form 40 or Form 40NR.

- Fill in line 2 with the net tax due as shown on your 2007 return from the specified lines of Form 40 or Form 40NR.

- On line 3, indicate all Alabama income tax withheld for the year 2008.

- Calculate the total underpayment for the year on line 4 by subtracting line 3 from line 1. Proceed only if the result is positive.

- Complete line 5 by entering either $50.00 or 10% of line 4, depending on the amount.

- If needing to complete Part II, start by entering your 2008 net tax due on line 1 as specified.

- Continue through the steps outlined in Part II, ensuring each figure reflects your estimated payments accurately.

- Review the entire form for accuracy and completeness. Ensure that every required field is filled before moving to the next section.

- Once finished, choose to save your changes, download, print or share the completed form as needed.

Complete your documents online today for a smoother filing experience.

To attach documents to your tax return, align the additional forms behind your primary return document. Be sure that each attachment is labeled properly and, if necessary, reference them within the main form, particularly if you are attaching to Form 40 or Form 40NR. Proper organization helps in the processing of your return and reduces the risk of errors. For tips and templates, check out uslegalforms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.