Loading

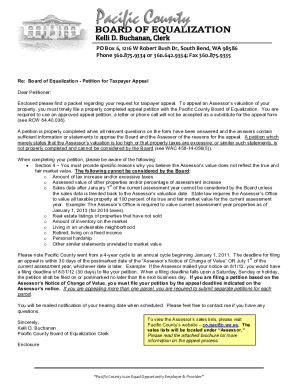

Get Get The Re: Board Of Equalization - Petition For Taxpayer Appeal

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Get The Re: Board Of Equalization - Petition For Taxpayer Appeal online

This guide provides clear instructions for filling out the Get The Re: Board Of Equalization - Petition For Taxpayer Appeal form online. By following these steps, users with varying levels of experience can ensure their appeal is submitted correctly and timely.

Follow the steps to successfully complete your taxpayer appeal petition.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

- Fill in the account or parcel number in the designated space at the top right corner of the petition. This number can be found on your determination notice or tax statement.

- Provide your name and the name of any authorized agent in the Owner section.

- Include mailing address information where all correspondence regarding the appeal will be sent, encompassing street address, city, state, and zip code.

- Enter your daytime phone number and fax number, if applicable.

- In the Property Description section, check all boxes that apply to your property (Leasehold, Commercial equipment, Farm equipment, Other).

- Provide a general description of the property including the address, location, and type of personal property.

- Input the Assessor’s determination of true and fair value as well as your estimate of true and fair value in the specified spaces.

- Attach a copy of your purchase price, including the date of purchase and the corresponding cost.

- If applicable, indicate whether the property has been remodeled or improved since purchase, providing the associated cost.

- State if the property has been appraised by another party, including the appraisal date and value, if applicable.

- List the most recent sales of comparable properties from the past five years, including descriptions and sales prices.

- Clearly articulate your specific reasons for believing that the assessed valuation does not reflect true and fair market value. Include supporting documentation such as maps, photographs, and letters.

- Check the appropriate statement regarding whether you intend to submit additional evidence before the hearing.

- Certify your petition by signing and dating it at the bottom, indicating that the information provided is accurate to the best of your knowledge.

- Review all filled information for accuracy and completeness, then save changes to your document.

- Finally, download, print, or share your completed petition as necessary.

Get started now by completing your petition online.

If you believe your property tax assessment is inaccurate, appealing can be beneficial. Many residents find that assessments do not reflect their property's actual market value. By appealing, you have the opportunity to potentially lower your tax liability. You can effectively initiate this process by deciding to Get The Re: Board Of Equalization - Petition For Taxpayer Appeal.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.