Get Canada Csio Ca2001e 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada CSIO CA2001e online

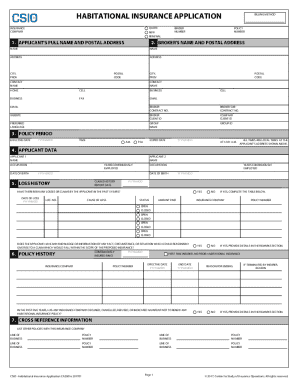

Filling out the Canada CSIO CA2001e form is an essential step for obtaining habitational insurance in Canada. This guide will provide you with a clear and comprehensive walkthrough of the form, ensuring that you understand each section and can complete it correctly.

Follow the steps to successfully complete the form online.

- Click the ‘Get Form’ button to access the CA2001e form and open it in your preferred online editor.

- Enter the applicant's full name and postal address in Section 1. Ensure that the address includes city, province, and postal code.

- Provide the broker's name and postal address in Section 2. Include relevant contact details such as business phone numbers and email addresses.

- In Section 3, fill out the policy period, including the effective date and expiry date. Make sure to use the format YYYYMMDD.

- Section 4 requires personal data from the applicants, including their names, occupations, and dates of birth. Include the years of continuous employment for each applicant.

- In Section 5, disclose any loss history over the past five years. If there have been losses, fill in the table provided with details such as the date of loss and the insurance company involved.

- Complete Section 6, providing any details regarding the policy history, including prior insurance coverage and reasons for any cancellations.

- In Section 7, list any other policies held with the insurance company and provide their respective details.

- Section 8 involves entering the risk address. If it is the same as the postal address, indicate that accordingly.

- Fill in Section 9 with rating information related to the property, including details such as the number of storeys and year built.

- In Section 10, enter the mortgagee or loss payee information, ensuring all required fields are completed.

- Proceed through subsequent sections, ensuring that all questions regarding liability exposures, coverages, discounts, and the personal information consent are answered accurately.

- Finally, review all the provided information for accuracy. Save changes, download, or print the completed form as necessary.

Complete your documents online today to ensure your habitational insurance application is processed smoothly.

Filing a consumer proposal in Canada involves working with a licensed Insolvency Trustee who will help you create an offer to your creditors. This proposal outlines how much you can repay based on your financial situation. Once accepted, it protects you from creditor actions. If you need assistance with this process, information related to the Canada CSIO CA2001e can guide you.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.