Loading

Get Ar Ar4p 2025-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR AR4P online

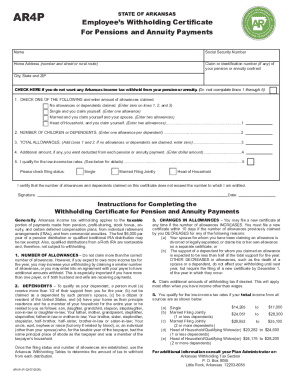

Filling out the AR AR4P form for pensions and annuity payments is an essential step in managing your tax withholding obligations. This guide will provide clear, step-by-step instructions on how to accurately complete the form online, ensuring you remain compliant with Arkansas tax laws.

Follow the steps to complete your AR AR4P form online.

- Click ‘Get Form’ button to obtain the AR AR4P form and open it in your preferred online editor.

- Enter your full name as it appears on official documents in the designated field.

- Provide your Social Security Number in the appropriate box to ensure proper identification.

- Fill in your home address with the number and street or rural route, along with your city, state, and ZIP code.

- If you have a claim or identification number related to your pension or annuity contract, input it in the designated section.

- For withholding preferences, check the box if you do not want any Arkansas income tax withheld from your pension or annuity. If you choose to have withholding, continue to lines 1 through 5.

- In line 1, select one of the following options for allowances: no allowances, single, married, or head of household, and enter the corresponding number.

- In line 2, state the number of children or dependents you are claiming. Enter one allowance for each dependent.

- Calculate the total allowances by adding the amounts from lines 1 and 2. Input this total in line 3.

- If you wish to have an additional amount deducted from each payment, specify that amount in line 4.

- If you qualify for low-income tax rates, be sure to check the appropriate option in line 5.

- Select your filing status by marking the corresponding box: single, married filing jointly, or head of household.

- Finally, sign and date the form to certify the information is accurate. Make sure to save your changes before downloading or printing the completed form.

Complete your AR AR4P form online today to manage your tax withholdings efficiently.

Obtaining a CSI file without logging in can be challenging, as many platforms require authentication for access. However, some services might allow limited access to certain documents. Reaching out to AR AR4P support can provide guidance on how to obtain the file you need while maintaining security.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.