Loading

Get Form 433f (rev. 7-2024)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 433F (Rev. 7-2024) online

Filling out Form 433F (Rev. 7-2024) online is a critical step for individuals needing to communicate their financial situation to the IRS. This guide offers a user-friendly, step-by-step approach to ensure you complete the form accurately and efficiently.

Follow the steps to effectively complete your Form 433F online.

- Click the ‘Get Form’ button to access the form and open it for editing.

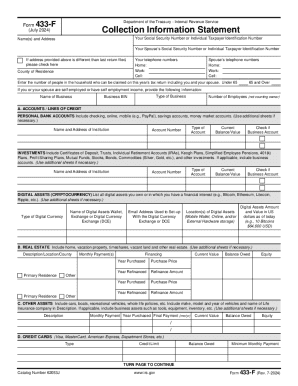

- Enter your Social Security Number or Individual Taxpayer Identification Number in the designated field. Additionally, fill in your name and address correctly.

- If applicable, provide your partner’s Social Security Number or Individual Taxpayer Identification Number. Check the box if the address above differs from the last filed return.

- Fill out your county of residence and provide your and your partner's telephone numbers for home, work, and cell as needed.

- Indicate the number of people in your household who can be claimed on this year’s tax return, along with those under and over 65.

- If self-employed or receiving self-employment income, list your business name, type, Employer Identification Number, and number of employees.

- In Section A, list all personal bank accounts, including checking, savings, and online accounts. Fill in the institution name, type, account number, and current balance.

- In Section B, document any real estate you own, detailing the description, location, current value, and any monthly payments associated.

- In Section C, include details about other assets you possess, such as vehicles, with descriptions and values.

- Complete Section D by listing all credit cards with relevant details like credit limit and balance owed.

- In Section E, provide business information if applicable, including accounts receivable and payment details if your business accepts credit cards.

- Fill out Section F regarding your employment information, including your employer's name and payment frequency.

- List all non-wage household income and necessary monthly living expenses in Sections G and H, respectively.

- Once all sections are filled out correctly, review the form for accuracy. Finally, save your changes, download it as needed, print it, or share it as required.

Start completing your Form 433F online today to manage your tax situation effectively.

The fax number 855 309 9361 is not universally recognized as an IRS fax number for general inquiries. However, ensure you verify fax numbers directly through the IRS resources or instructions related to your situation, such as those listed for Form 433F (Rev. 7-2024). Using the correct number is vital to ensure your documents are received and processed promptly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.