Get 421-a Executive Center Blvd

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

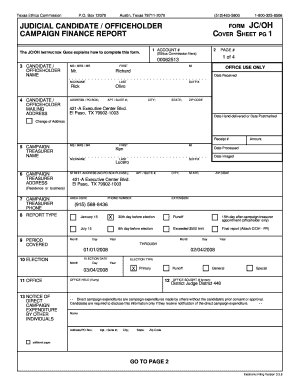

How to fill out the 421-A Executive Center Blvd online

This guide is designed to help users navigate the process of completing the 421-A Executive Center Blvd form online. Whether you are a first-time filer or need a refresher, this comprehensive walkthrough will provide you with the clear steps necessary to successfully complete this important document.

Follow the steps to fill out the form accurately and efficiently.

- Click the ‘Get Form’ button to obtain the form and open it in your editing tool.

- Begin by filling in your name as the candidate or officeholder. Include your first name, middle initial, last name, and suffix if applicable.

- Provide your mailing address, ensuring all relevant details are filled out including apartment or suite number, city, state, and zip code.

- Next, enter the name and address of your campaign treasurer, including their first name, middle initial, last name, and suffix. Complete the address fields as specified.

- Fill in the campaign treasurer's phone number, ensuring to include the area code.

- Specify the report type you are filing, opting for January 15, July 15, or other applicable periods. Check the corresponding box.

- Indicate the period covered by your report, filling in the relevant month, day, and year.

- Provide the relevant election date by filling out the day, month, and year fields.

- Identify the type of election by marking either primary, general, runoff or special.

- Complete the section detailing any direct campaign expenditures made by other individuals, if applicable. This includes providing names and addresses.

- Fill in the section for contribution totals, providing accurate amounts for political contributions, expenditures, and any outstanding loans.

- Ensure you sign and date the affidavit portion, affirming that the information reported is true and accurate. A notary seal must be affixed above your signature.

- Once all sections have been completed, review your form for accuracy. You can save any changes, download, print, or share the form as required.

Ready to begin? Complete your 421-A Executive Center Blvd form online today!

A 421a surcharge is an additional tax that may apply when certain conditions are not met under the 421a program. If a property at 421-A Executive Center Blvd does not adhere to specific affordability requirements, owners may face these surcharges. This ensures that developers who benefit from the exemption still contribute to the city's tax base. Knowing how surcharges work can help you navigate potential financial implications.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.