Get Standard Procedures And Language In Foreclosure Proceedings;

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the STANDARD PROCEDURES AND LANGUAGE IN FORECLOSURE PROCEEDINGS; online

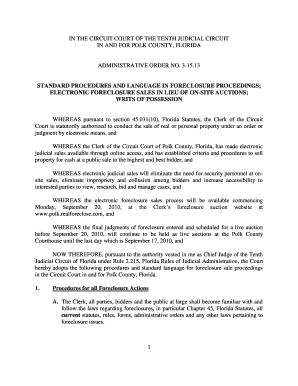

Filling out the Standard Procedures and Language in Foreclosure Proceedings form is an essential process for individuals involved in foreclosure cases. This guide aims to provide you with clear, step-by-step instructions to navigate the form effectively online.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access the document and open it in your preferred editing tool.

- Carefully read the introductory sections of the form, which outline the purpose and essential laws related to foreclosure procedures. Understanding this context is crucial before proceeding to fill out specific details.

- Begin filling out the section for plaintiffs. Include your name, contact information, and any relevant case numbers. Ensure all entries are accurate to avoid delays in processing.

- Complete the fields related to the final judgment content. Refer to the specific guidelines that include language requirements and statements regarding bidding details, including the starting time and location.

- If applicable, fill out the Writ of Possession section by certifying tenant status if there are individuals currently residing in the property. Include the required certification language as indicated in the guidelines.

- Review your entries for correctness. It is important to verify that all sections are completed as required by the Administrative Order references.

- Once satisfied with the accuracy of the information, proceed to save your changes. You may also consider downloading, printing, or sharing the completed form as necessary.

Start filling out your documents online to ensure compliance with foreclosure procedures.

In New York, the timeframe for a home to enter foreclosure can range from several months to a few years, depending on various factors, such as lender practices and court schedules. The judicial nature of the process means that it adheres to standardized procedures and language in foreclosure proceedings, which can extend the timeline. Staying informed about your rights can aid you in understanding and potentially accelerating the process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.