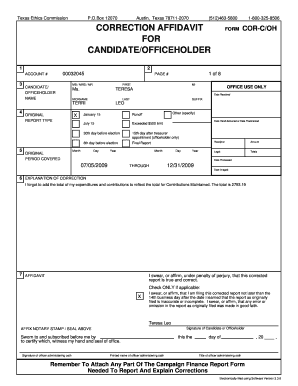

Get I Forgot To Add The Total Of My Expenditures And Contributions To Reflect The Total For

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the I Forgot To Add The Total Of My Expenditures And Contributions To Reflect The Total For online

Filling out the I Forgot To Add The Total Of My Expenditures And Contributions To Reflect The Total For form is essential for maintaining accurate campaign finance records. This guide provides clear instructions on how to complete the form online, ensuring that your financial reporting is both accurate and compliant.

Follow the steps to effectively complete your form.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Identify the section labeled 'Candidate/Officeholder Name' and provide your full name as it appears in official records. Include any suffixes as required.

- In the 'Original Report Type' field, select the type of report you are correctively filing. Indicate the original reporting period.

- Complete the 'Account Number' section by entering your assigned account number. This helps authorities track your filings accurately.

- Under the 'Explanation of Correction' section, specify the reason for the correction. Clearly state the omission related to your expenditures and contributions, as shown in the example of 'I forgot to add the total of my expenditures and contributions to reflect the total for Contributions Maintained.'

- In the 'Total Political Contributions Maintained' field, enter the corrected total amount reflecting your contributions, for example, '2,793.19'.

- Sign the affidavit confirming that the correction is accurate, under penalty of perjury. Make sure to include your printed name, the date, and the title of the officer administering the oath if necessary.

- Once all sections are completed, review the form for accuracy. After final verification, you can save your changes, download the completed form, print it, or share it as needed.

Ensure your campaign finance reports are accurate by completing the necessary forms online today.

Yes, you can use expenses from previous years when filing amended tax returns or in certain situations where carryovers apply. It's vital to document these expenses accurately to ensure compliance with tax regulations. Being proactive about your claims can yield a more favorable tax situation. Don't forget, I Forgot To Add The Total Of My Expenditures And Contributions To Reflect The Total For highlights the need for often revisiting past records.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.