Loading

Get W-2 Instructions For Employee Box 1. Enter This Amount On The ... - Hhsc State Tx

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W-2 Instructions For Employee Box 1 online

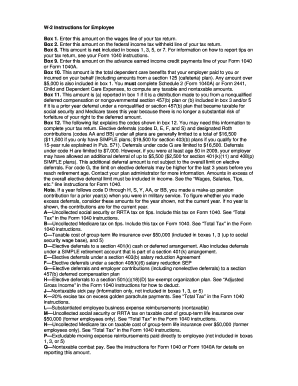

This guide provides clear and structured instructions for completing the W-2 Instructions for Employee, focusing on Box 1. Understanding how to accurately fill out this box ensures proper reporting for your tax return.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to access the W-2 Instructions for Employee form and open it for editing.

- Locate Box 1 on the form. This box contains the total wages that you received during the tax year. Ensure that this amount is accurately reflected from your payroll records.

- Refer to Box 2, which details the federal income tax withheld. You will need this information when completing your tax return.

- In Box 8, identify any tip amounts that are not included in the wages reported in Boxes 1, 3, 5, or 7. Ensure you understand how to report these tips on your Form 1040.

- For Box 9, make a note of any advance earned income credit payments. This will be important for filling out your Form 1040 or Form 1040A.

- Proceed to Box 10 to check the total dependent care benefits paid or incurred on your behalf. If this exceeds $5,000, take note as it will be relevant for your tax computations.

- When reaching Box 12, review the explanatory codes carefully. These codes will guide you on various elective deferrals, contributions, and potential additional tax implications.

- Check Box 13 for the retirement plan indicator, which may affect your IRA contribution deductibility.

- After verifying all information, save your changes to the form. You can then download, print, or share the completed W-2 form as needed.

Complete your W-2 documents online to ensure timely and accurate filing.

Box one on your W-2 is where your total taxable wages are listed, which includes your salary and any bonuses. It is important to review this figure because it directly impacts your tax liability. If you have questions about your earnings or how they are calculated, consult the W-2 Instructions For Employee Box 1. Enter This Amount On The ... - Hhsc State Tx for helpful insights.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.