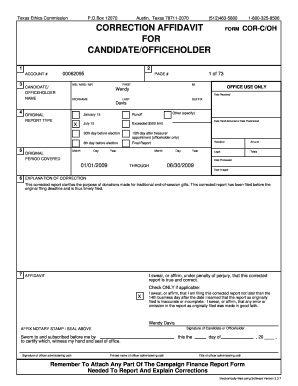

Get This Corrected Report Clarifies The Purpose Of Donations Made For Traditional End-of-session Gifts

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the This Corrected Report Clarifies The Purpose Of Donations Made For Traditional End-of-session Gifts online

Filling out the This Corrected Report Clarifies The Purpose Of Donations Made For Traditional End-of-session Gifts is essential for ensuring transparency in political contributions. This guide provides clear, step-by-step instructions to assist you in completing the form accurately and efficiently online.

Follow the steps to successfully complete your Corrected Report

- Click the ‘Get Form’ button to access the form, which will open in your online editor.

- Begin by entering the candidate or officeholder's name. Ensure that you include any applicable middle initials and suffixes.

- In the account number field, provide the unique identifier associated with the candidate or officeholder. This is typically provided by the Texas Ethics Commission.

- Select the type of report you are submitting. Indicate that this is a corrected report clarifying the purpose of donations for traditional end-of-session gifts.

- Fill in the periods covered for the contributions and donations to reflect the accurate time frame pertaining to your report.

- Provide a detailed explanation of the correction in the section designated for corrections, specifically addressing any inaccuracies from prior reports.

- Complete the affidavit section by signing and dating the report to affirm its accuracy and compliance with legal requirements.

- Review all sections of the form for completeness and accuracy before submitting.

- Save your changes, and once finalized, download, print, or share the document as needed.

Take action now to complete and submit your corrected report online to ensure compliance with Texas ethics regulations.

To document donations for tax purposes, maintain a folder of all related paperwork, including receipts and acknowledgement letters. Ensure that you record the date, amount, and purpose of each donation, as the IRS requires specific information for tax deductions. This Corrected Report Clarifies The Purpose Of Donations Made For Traditional End-of-session Gifts, aiding in accurate tax reporting and compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.