Get 2011 Ig259, Firetown Premium Report - Minnesota Department Of ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 IG259, Firetown Premium Report - Minnesota Department of Revenue online

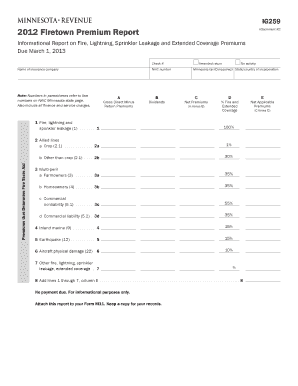

Filling out the 2011 IG259, Firetown Premium Report is an essential task for insurance companies in Minnesota. This guide provides a step-by-step approach to completing the form online, ensuring accuracy and compliance with the filing requirements.

Follow the steps to successfully complete the IG259 form.

- Press the ‘Get Form’ button to obtain the IG259 and open it in the designated online editor.

- Review the top section of the form where you will indicate if you are submitting an amended return or reporting no activity for the year. Select the appropriate checkbox.

- Enter your insurance company's name and NAIC number in the provided fields to identify your organization.

- Fill in the Minnesota tax ID and state or country of incorporation in the designated areas.

- Calculate the Gross Direct Minus Dividends by completing the necessary fields and follow the prompts to input your net premiums and return premiums.

- Input the percentages for fire and extended coverage in the relevant fields for each category of insurance listed, ensuring you check against the NAIC Minnesota state page.

- Total all applicable premiums by adding the values from columns, ensuring accuracy in your final calculations.

- Once you have completed all sections of the form, review for clarity and correctness before proceeding to save your work.

- Save changes to your completed form, and then proceed to download, print, or share the IG259 as necessary.

Complete your IG259 Firetown Premium Report online today to ensure timely filing.

In Minnesota, certain items are exempt from sales tax, including most food purchases, prescription drugs, and clothing under a specified value. Additionally, services like health care and educational services are generally not taxed. Understanding these exemptions can help you better navigate your financial obligations and can often be found in resources such as the 2011 IG259, Firetown Premium Report - Minnesota Department Of. Uslegalforms provides tools and templates to help clarify tax-related questions concerning taxable and non-taxable items.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.