Get Part-160 Nj Division Of Taxation (10-11) Partnership Name Underpayment Of Estimated N

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PART-160 NJ Division Of Taxation (10-11) PARTNERSHIP NAME Underpayment Of Estimated N online

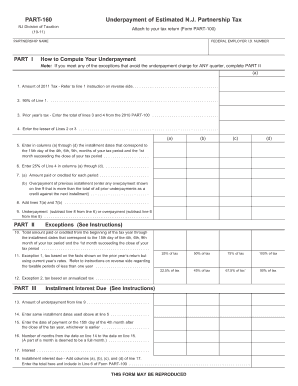

This guide provides a comprehensive overview of how to complete the PART-160 NJ Division of Taxation (10-11) Partnership Name Underpayment of Estimated N form online. Whether you are a seasoned tax professional or new to tax filing, this user-friendly walkthrough will help you navigate each section with clarity.

Follow the steps to accurately complete your underpayment form.

- Click 'Get Form' button to obtain the form and open it in your preferred editor.

- Begin with Part I. Input the partnership name as required in the designated field.

- Next, provide the Federal Employer I.D. Number in the corresponding field.

- For Line 1, enter the amount of tax from the prior year as instructed.

- On Line 2, calculate and input 90% of the amount from Line 1.

- Enter the total of Lines 3 and 4 from the previous year's PART-100 on Line 3.

- On Line 4, input the lesser amount from Lines 2 or 3.

- For Line 5, fill in the installment dates corresponding to the 15th day of the 4th, 6th, 9th months, and the next month after your tax period ends.

- Enter 25% of Line 4 in each column (a-d) on Line 6.

- In Line 7(a), indicate the amounts paid or credited for each period.

- For Line 7(b), document any overpay shown on Line 9 that exceeds previous total underpayments.

- Calculate the total for Line 8 by adding Lines 7(a) and 7(b).

- On Line 9, subtract Line 8 from Line 6 to find if there is an underpayment or an overpayment.

- If applicable, move to Part II and explore exceptions for any underpayments you calculated.

- Complete Part III only if no exceptions apply. Enter amounts as specified for underpayment and interest calculation.

- Once all sections are complete, review your entries for accuracy.

- Save your changes, and use options to download, print, or share the completed form as necessary.

Begin your form completion online today to ensure timely and accurate submissions.

Business tax rates in New Jersey vary based on the type of business entity and the income level. For corporations, the tax rate ranges from 6.5% to 11.5% depending on the income bracket. Partnerships typically pass their income through to individual partners, who then report their share on personal returns, which may also influence taxes owed. To understand your specific obligations, it's wise to review the PART-160 NJ Division Of Taxation (10-11) PARTNERSHIP NAME Underpayment Of Estimated N provisions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.