Loading

Get 2010 Div, Deduction For Dividends Received - Minnesota ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2010 DIV, Deduction for dividends received - Minnesota online

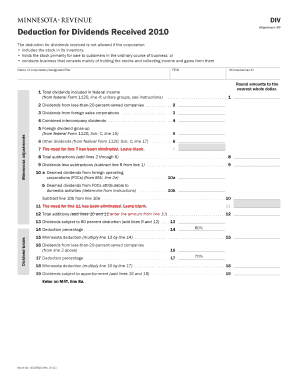

Filling out the 2010 DIV form is essential for corporations seeking a deduction for dividends received in Minnesota. This guide provides clear and concise instructions to help users navigate the form effectively online.

Follow the steps to complete the 2010 DIV form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the corporation or designated filer in the designated field.

- Input the Federal Employer Identification Number (FEIN) of the corporation.

- Provide the Minnesota tax ID number associated with the corporation.

- Complete line 1 by recording the total dividends included in federal income as reported on federal Form 1120, line 4.

- Continue to line 2 and record dividends received from less-than-20-percent-owned companies.

- On line 3, enter any dividends from foreign sales corporations as applicable.

- In the Minnesota adjustments section, fill in line 4 with any combined intercompany dividends.

- For line 5, provide the foreign dividend gross-up amount from federal Form 1120, Schedule C, line 15.

- Complete line 6 with other dividends reported from federal Form 1120, Schedule C, line 17.

- Skip line 7, as the need for it has been eliminated.

- For line 8, total the subtractions by adding lines 2 through 6.

- Subtract line 8 from line 1 to determine dividends less subtractions on line 9.

- For lines 10a and 10b, input deemed dividends from foreign operating corporations and determine the appropriate deductions.

- Leave line 11 blank as indicated.

- On line 12, total the additions by adding lines 10 and 11 as per the instructions.

- Add lines 9 and 12 together for line 13 to determine dividends subject to an 80 percent deduction.

- Specify the deduction percentage, entering 80% in line 14.

- Multiply the amount on line 13 by the deduction percentage for line 15 to find the Minnesota deduction.

- Record dividends from less-than-20-percent-owned companies on line 16.

- Specify the deduction percentage as 70% in line 17.

- Calculate the Minnesota deduction for line 18 by multiplying line 16 by line 17.

- Finally, add lines 15 and 18 for line 19, which indicates dividends subject to apportionment, ensuring to enter the total on M4T, line 8a.

- Once you have completed the form, save changes, download, print, or share the form as needed.

Complete your 2010 DIV form online today to ensure accurate deductions for dividends received.

Yes, Minnesota taxes capital gains as part of your income tax. The tax rate may vary based on your total income and the length of time an asset was held. To navigate the complexities of capital gains tax, UsLegalForms can provide resources and documentation to ensure you file accurately and comply with state tax requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.