Loading

Get Form Ct-7 Virginia Communications Use Tax Return ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form CT-7 Virginia Communications Use Tax Return online

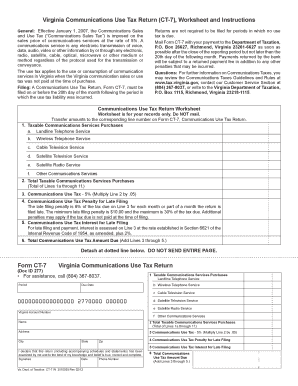

The Form CT-7 serves as the Virginia Communications Use Tax Return, designed for individuals and businesses to report and pay communications use tax. This guide provides straightforward, step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to successfully fill out the Form CT-7 online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

- Begin by providing the necessary period information at the top of the form, specifying the month and year for which the tax return is being filed.

- Enter your Virginia account number in the designated field, ensuring accuracy to avoid processing delays.

- Fill in the personal or business name, address, city, state, and zip code in the corresponding fields to identify the taxpayer.

- Report your taxable communications services purchases. List amounts for landline telephone service, wireless telephone service, cable television service, satellite television service, satellite radio service, and other communications services under section 1.

- Calculate the total of lines 1a through 1f and enter the amount on Line 2, representing your total taxable communications services purchases.

- Compute the communications use tax by multiplying the total reported on Line 2 by 5% and enter this amount on Line 3.

- If applicable, calculate any penalties for late filing on Line 4, which is 6% of the tax due on Line 3 for each month it is late.

- Assess any interest for late filing on Line 5, as outlined in the instructions.

- Finally, add the amounts from lines 3, 4, and 5 to determine the total communications use tax amount due. Enter this final figure on Line 6.

- Once all fields are accurately completed, review the form to ensure correctness, then save your changes, and proceed to download, print, or share your completed form as necessary.

Take the next step and complete your Form CT-7 online today.

To ensure your Virginia tax return is complete, you should include your completed tax form, supporting schedules, and any relevant documentation for income and deductions. This may include W-2 forms, receipts for business expenses, and proof of estimated tax payments. Remember, accurate records lead to a smoother filing process. Utilize US Legal Forms to find all necessary forms and guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.