Loading

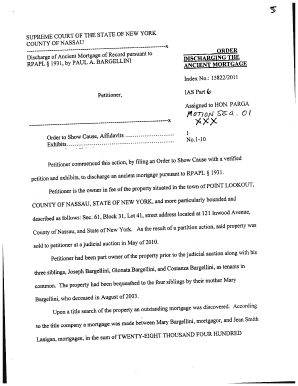

Get Discharge Of Ancient Mortgage Of Record Pursuant To

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Discharge Of Ancient Mortgage Of Record Pursuant To online

This guide provides straightforward instructions for completing the Discharge Of Ancient Mortgage Of Record Pursuant To form online. Whether you have little legal experience or are seeking clarity on specific sections, this guide is designed to support you through the process.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to access the form and open it in your preferred editing program.

- Review the first section of the form, which typically asks for information regarding the petitioner, including full name, address, and relationship to the property in question.

- Provide detailed property information in the designated fields, including the specific address and any identification numbers associated with the property, such as section, block, and lot numbers.

- Reference the relevant mortgage details, ensuring to include the mortgage amount, date of the mortgage, and names of the mortgagor and mortgagee as found in your title search.

- Complete any required fields regarding past ownership and provide evidence, such as copies of death certificates for involved parties, particularly if they are deceased, to substantiate your claims.

- Review the 'request' section of the form, where you will formally ask the court to discharge the mortgage, including the basis for this request, such as lack of evidence of payment after the lapse of twenty years.

- Finalize your submission by checking all entered information for accuracy, and save your changes. Once satisfied, download or print the form to retain a copy for your records.

- Complete your submission by following any additional instructions provided; this may involve filing the document with the county clerk or sharing it with involved parties.

Start completing your documents online today to ensure a smooth filing process.

In New York, the statute of limitations for foreclosing a mortgage is generally six years. This means that a lender must initiate foreclosure proceedings within this timeframe. If the lender does not act, the mortgage may be considered unenforceable. This is important when considering a discharge of ancient mortgage of record pursuant to New York laws.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.