Get Virginia Consumers Use Tax Return For Individuals, Form Cu-7 - Tax Virginia

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Virginia Consumers Use Tax Return For Individuals, Form CU-7 - Tax Virginia online

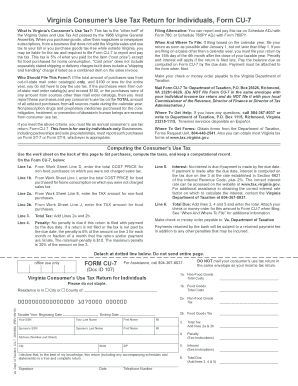

Filing the Virginia Consumers Use Tax Return for Individuals, Form CU-7, is an essential step for users who have purchased goods that were not taxed at the time of sale. This guide provides clear, step-by-step instructions to help you successfully complete the form online.

Follow the steps to complete your tax return accurately.

- Press the ‘Get Form’ button to access the Virginia Consumers Use Tax Return Form CU-7 and open it in your preferred online editor.

- Begin by entering your personal information at the top of the form, including your Social Security Number and your name. If applicable, provide your spouse’s information as well.

- Indicate the location of your residence by selecting the appropriate city or county in Virginia.

- In the ‘Taxable Year’ section, fill in the beginning and ending dates of the tax year for which you are filing.

- Compute the total cost price for non-food goods on which you were not charged sales tax and enter this amount on Line 1a.

- Calculate the total cost price for food purchased for home consumption and enter it on Line 1b.

- Use the provided worksheet to determine the tax amount for non-food purchases (Line 2a) by multiplying the total costs by 5%. Then, calculate the tax amount for food purchases (Line 2b) by using the rate of 2.5%.

- Add the totals from Lines 2a and 2b to calculate the total tax due and enter this amount on Line 3.

- If applicable, calculate any penalties or interest and enter them on Lines 4 and 5 respectively. Finally, complete Line 6 by adding Lines 3, 4, and 5 to obtain the total amount due.

- Sign and date the form to declare that the information provided is accurate. Also, include your telephone number for any follow-up.

- Attach your check or money order for the total amount due to the completed Form CU-7. Ensure you do not send the form in the same envelope as your individual income tax return.

- Mail your completed form to the Department of Taxation at the provided address.

Start filling out your Virginia Consumers Use Tax Return online today to ensure compliance and accuracy.

The terms 'use tax' and 'consumer use tax' often refer to the same tax liability but can differ slightly based on context. Generally, use tax applies to tangible goods purchased from out-of-state vendors where sales tax was not collected. On the other hand, consumer use tax specifically targets individuals who consume these goods within Virginia. Understanding these terms can help ensure proper compliance when filing your Virginia Consumers Use Tax Return For Individuals, Form CU-7 - Tax Virginia.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.