Loading

Get Drive Underwriting Guidelines 2007-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Drive Underwriting Guidelines online

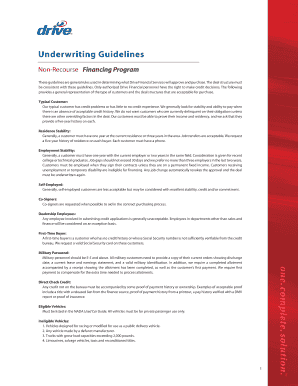

This guide offers step-by-step instructions on completing the Drive Underwriting Guidelines form. By following these detailed instructions, users can navigate the form with ease, ensuring a smooth and efficient submission process.

Follow the steps to fill out the Drive Underwriting Guidelines online.

- Click ‘Get Form’ button to access the guidelines and open them for review.

- Begin with the customer information section, where you will input the applicant's full name, contact details, and Social Security number if applicable. This information is crucial for identity verification.

- Proceed to the residence stability field. Indicate the duration of the current residence and provide a five-year history. Ensure the input reflects the stability of the applicant's living situation.

- In the employment stability section, document the applicant's employment history, including the length of employment and type of job. Note any acceptable job transfers or recent graduates.

- If applicable, complete the self-employed customer's section with detailed income verification documents like tax returns and bank statements as per guidelines.

- Input details concerning the co-signer if one is provided. This may bolster the application by enhancing credibility.

- Complete the vehicle eligibility section by ensuring the vehicle is listed in the NADA Used Car Guide, providing all necessary vehicle details.

- Fill out the income criteria section, confirming the minimum income requirements for individual and joint applicants, alongside supporting documentation.

- Attach proof of income and address as outlined in the guidelines, ensuring all documents are clear and legible for the underwriting process.

- Finalize the application by reviewing all entered information for accuracy. Once confirmed, save changes, and utilize options to download, print, or share the completed form.

Start filling out the Drive Underwriting Guidelines online today to streamline your financing process.

The steps in underwriting typically include gathering documentation, analyzing the applicant's financial information, assessing risk, and making a recommendation. Each step requires careful consideration of the Drive Underwriting Guidelines to ensure compliance and accuracy. Following these steps can lead to a smoother underwriting experience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.