Loading

Get Ca Form 3548 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA Form 3548 online

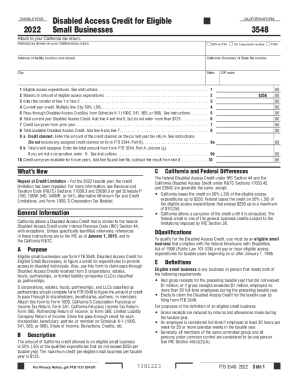

Filling out the CA Form 3548 is essential for eligible small businesses seeking to claim the Disabled Access Credit. This credit helps businesses offset expenses related to providing access to disabled individuals, and completing the form accurately is crucial for maximizing potential benefits.

Follow the steps to complete your CA Form 3548 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name(s) as shown on your California tax return in the designated field. Choose the appropriate identification type: SSN, ITIN, CA Corporation number, or FEIN.

- Fill in the address of your facility, including the street number, city, state, and ZIP code.

- In line 1, report the total eligible access expenditures incurred during the taxable year.

- On line 2, indicate the maximum amount of eligible access expenditures allowed.

- Enter the smaller value of line 1 or line 2 in line 3.

- Calculate the current year credit by multiplying the amount from line 3 by 50% (0.50) and enter it in line 4.

- If applicable, note any pass-through Disabled Access Credits received from relevant entities on line 5.

- Add the amounts from lines 4 and 5, not exceeding $125, and put the total on line 6.

- Record any credit carryover from the prior year on line 7.

- Add the amounts from line 6 and line 7 for the total available Disabled Access Credit on line 8.

- In lines 9a and 9b, document the credit claimed and total credit assigned accordingly.

- Finally, calculate any carryover available for future years in line 10.

- Review your entries for accuracy, then save any changes, download, print, or share the completed form.

Complete your CA Form 3548 online today to claim your Disabled Access Credit.

Filling out form VA 4 requires you to provide personal information and determine the number of allowances you wish to claim. Carefully follow the instructions, particularly regarding the calculation of allowances based on your filing status. Resources like the CA Form 3548 can offer additional insights into the process and ensure you meet all requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.