Get Ca Form 3548 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA Form 3548 online

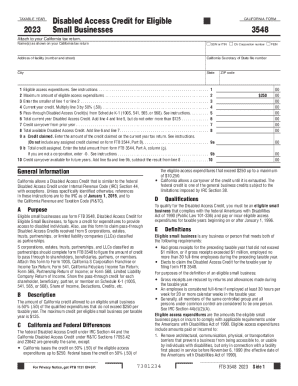

This guide provides users with a clear, step-by-step process for completing the California Form 3548, which is crucial for small businesses claiming the Disabled Access Credit. By following these instructions, users can efficiently navigate the online filling process and ensure accurate submission.

Follow the steps to complete the CA Form 3548 online

- Press the ‘Get Form’ button to download the form. This action allows you to open the CA Form 3548 in your preferred online editor.

- Begin by entering the name(s) as displayed on your California tax return, along with the corresponding identification numbers: SSN or ITIN, California Corporation number, or FEIN.

- Fill in the address of the facility, including the number and street, city, state, and ZIP code.

- In the section for eligible access expenditures, provide the total amount of qualifying expenditures incurred to enhance accessibility for individuals with disabilities.

- In the next field, indicate the maximum amount for eligible access expenditures, ensuring it does not exceed $250.

- For line 3, enter the smaller amount between line 1 and line 2 to determine the current eligible expenditures.

- Calculate the current year credit by taking 50% of the amount from line 3 and entering this amount on line 4.

- If applicable, list any pass-through Disabled Access Credits from Schedule K-1 on line 5.

- Add the amounts from lines 4 and 5 to find the total current year Disabled Access Credit, but ensure this does not exceed $125, and record it on line 6.

- Record any credit carryover from the prior year on line 7.

- On line 8, add the amounts from lines 6 and 7 to compute the total available Disabled Access Credit.

- Declare the amount of credit being claimed on your current year tax return on line 9a.

- If you are a corporation, complete line 9b; for other users, enter ‘0’.

- Finally, calculate the credit carryover available for future years on line 10 by adding line 9a and line 9b, then subtracting this result from line 8.

- After completing the form, save any changes. You can then download, print, or share the filled form as necessary.

Complete your form online today to ensure you receive your eligible credits.

The proposed date of remittance in Form 15CB is typically the date when the payment is expected to be made to the Franchise Tax Board. Accurate timing of this date is crucial to avoid penalties or interest charges. Ensure the information aligns with your filing deadlines and payment strategies. For further assistance, uslegalforms provides resources to clarify your remittance obligations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.