Loading

Get Ct201-f, Monthly Cigarette Fee (for Minnesota Distributors). Annual Employment Report - Minnesota

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT201-F, Monthly Cigarette Fee (for Minnesota Distributors) online

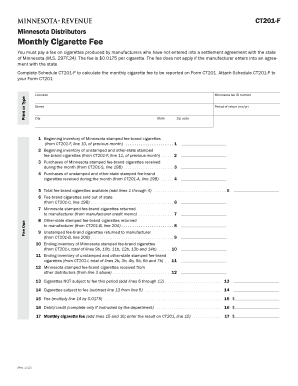

Understanding how to accurately complete the CT201-F, Monthly Cigarette Fee form is essential for Minnesota distributors. This guide will provide clear and concise instructions for each section of the form to ensure that all information is filled out correctly.

Follow the steps to complete the CT201-F form online:

- Click ‘Get Form’ button to access and open the CT201-F form.

- Fill in your licensee name and Minnesota tax ID number in the designated fields at the top of the form.

- Enter the period of return in the format 'mo/yr' where you will specify the month and year for which you are reporting.

- Input your street address, city, state, and zip code to complete your contact information accurately.

- Begin entering data into the inventory lines. Start with line 1, by entering the beginning inventory of Minnesota stamped fee-brand cigarettes from the previous month’s CT201-F, line 10.

- Proceed to line 2, where you will input the beginning inventory of unstamped and other-state stamped fee-brand cigarettes from CT201-F, line 11 of the prior month.

- On line 3, record purchases of Minnesota stamped fee-brand cigarettes received during the current month, referencing CT201-S, line 19B.

- For line 4, detail purchases of unstamped and other-state stamped fee-brand cigarettes received during the month, using CT201-A, line 19B.

- Calculate the total fee-brand cigarettes available by adding lines 1 through 4 and place the result on line 5.

- Fill in line 6 with the number of fee-brand cigarettes sold out of state, as indicated on CT201-C, line 19B.

- On line 7, input the quantity of Minnesota stamped fee-brand cigarettes returned to the manufacturer, sourced from your manufacturer credit memo.

- Line 8 requires the number of other-state stamped fee-brand cigarettes returned, as reported on CT201-B, line 20A.

- Record the quantity of unstamped fee-brand cigarettes returned to the manufacturer on line 9, from CT201-B, line 20B.

- For line 10, note the ending inventory of Minnesota stamped fee-brand cigarettes by referencing CT201-I.

- On line 11, detail the ending inventory of unstamped and other-state stamped fee-brand cigarettes based on CT201-I.

- Record the quantity of Minnesota stamped fee-brand cigarettes received from other distributors on line 12.

- Calculate the total cigarettes not subject to fee for line 13 by adding lines 6 through 12.

- On line 14, compute the number of cigarettes subject to the fee by subtracting line 13 from line 5.

- Multiply the result from line 14 by 0.0175 to determine the fee due; enter this on line 15.

- If instructed, complete line 16 for any debit or credit adjustments.

- Finally, add lines 15 and 16 for the total monthly cigarette fee, and enter this on line 17.

- Review all entries for accuracy before saving your changes; you have the option to download, print, or share the form as needed.

Take the next step by completing your CT201-F form online today.

Related links form

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.