Loading

Get Calculation Of Deemed Dividend

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Calculation of Deemed Dividend online

Completing the Calculation of Deemed Dividend form is essential for accurately reporting the deemed dividends of foreign operating corporations. This guide offers clear, step-by-step instructions to help users navigate the form with ease.

Follow the steps to effectively fill out the Calculation of Deemed Dividend form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

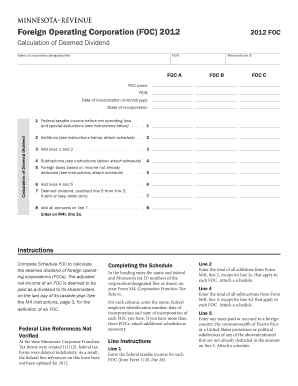

- In the heading, enter the name of the corporation or designated filer, along with the federal employer identification number (FEIN) and Minnesota tax ID number as they appear on your Form M4.

- For each foreign operating corporation (FOC), input the name, FEIN, date of incorporation (in mm/dd/yyyy format), and state of incorporation. If there are more than three FOCs, be sure to attach additional schedules as necessary.

- Line 1: Enter the federal taxable income for each FOC, which can be found on Form 1120, line 28.

- Line 2: Include the total of all additions from Form M4I, line 2, except for line 2e, that pertain to each FOC. Ensure you attach a schedule detailing these additions.

- Line 4: Report the total of all subtractions from Form M4I, line 4, excluding line 4d, that apply to each FOC on this line. Like before, attach a relevant schedule.

- Line 5: Enter any taxes paid or accrued to a foreign country or U.S. territory that are not already deducted in the amount reported on line 3. An accompanying schedule should also be attached.

- Line 6: Add the amounts from lines 4 and 5. This total will be used in the next calculation.

- Line 7: Calculate the deemed dividend by subtracting the amount on line 6 from the total on line 3. If this result is zero or less, write zero on this line.

- Line 8: Sum all amounts reported on line 7 and prepare to enter this total on M4I, line 2e.

- Once all fields are completed, you can save changes, download, print, or share the form as needed.

Complete your documents online with confidence and clarity.

A deemed distribution of dividends is a scenario where a company treats payments to shareholders as dividend distributions for tax purposes, even without formal dividend declarations. This situation can arise during share redemptions or liquidations. Mastering the concept of deemed distributions helps investors navigate potential tax obligations, enhancing their financial literacy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.