Loading

Get 2011 M3, Partnership Return - Minnesota Department Of Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 M3, Partnership Return - Minnesota Department Of Revenue online

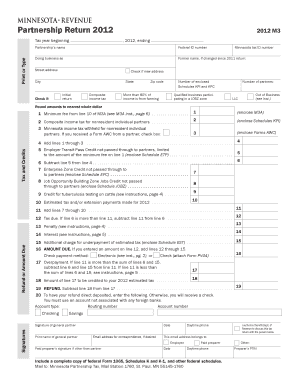

Navigating the 2011 M3, Partnership Return for the Minnesota Department of Revenue can seem challenging. This guide provides a straightforward approach to completing the form online, ensuring that you understand each section and field clearly.

Follow the steps to successfully complete your M3 partnership return online.

- Click ‘Get Form’ button to access the 2011 M3 partnership return and open it in your editing tool.

- Enter the partnership’s name at the top of the form along with the federal identification number. If the partnership operates under a different name, provide that in the 'Doing business as' field.

- Indicate the tax year by filling in the beginning and ending dates at the specified sections.

- Provide the street address, city, state, and zip code of the partnership. Check the box if there is a new address.

- If applicable, fill in the Minnesota Tax ID number. Indicate whether this is an initial return or if the partnership is opting for composite income tax.

- Complete the section regarding the number of enclosed Schedules KPI and KPC and check the box if more than 80% of income is from farming or if the business qualifies for the JOBZ zone.

- Proceed to the tax and credits section, beginning with the minimum fee from line 10 of M3A. Be sure to enclose M3A.

- Include the composite income tax for nonresident individual partners and fill in the amount of Minnesota income tax withheld for nonresident individual partners.

- Add up the amounts on lines 1 through 3 and carry the total to the next line.

- Complete the calculations for credits, including any not passed through to partners, and fill out estimated tax and payments.

- Deduct any penalties or additional charges applicable, and ensure the total is calculated correctly.

- Review the refund or amount due section, providing necessary bank details if a refund is expected via direct deposit.

- Sign the form at the bottom by the general partner, including print name, daytime phone, and optionally an email address for correspondence.

- Ensure any paid preparer's information is filled out, if applicable, including their signature and PTIN.

- Finally, include a complete copy of federal Form 1065 along with Schedules K and K-1, and send the completed form to the indicated mailing address.

Complete your 2011 M3 partnership return online today for a smooth filing process.

You can obtain Minnesota tax forms directly from the Minnesota Department Of Revenue’s website. If you require forms for partnerships, including the 2011 M3, Partnership Return - Minnesota Department Of Revenue, it is readily accessible online. This resource allows you to download and print the necessary documents for filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.