Loading

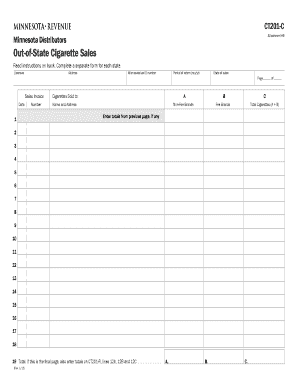

Get Ct201-c, Out-of-state Cigarette Sales (for Minnesota Distributors)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT201-C, Out-of-State Cigarette Sales (for Minnesota Distributors) online

The CT201-C form is essential for Minnesota distributors reporting out-of-state cigarette sales. This guide provides clear, step-by-step instructions to assist users in completing the form effectively online.

Follow the steps to complete your CT201-C form online.

- Click ‘Get Form’ button to obtain the form and access it in the editing format.

- Begin by filling in the licensee information. Provide your name and address in the designated fields, ensuring accuracy for identification purposes.

- Enter your Minnesota tax ID number in the relevant field. This number is crucial for tax identification and reporting.

- Indicate the period of return by specifying the month and year (mo/yr) for which the sales are being reported.

- List the state of sales where the cigarette sales occurred in the appropriate section.

- Under the Sales Invoice section, record the sales date and the invoice number associated with the transactions.

- Complete the Cigarettes Sold to section, including the name and address of the buyer in the specified fields.

- Divide the total cigarette sales into two categories: Non-Fee Brands and Fee Brands. Fill in the quantities sold under each category as appropriate.

- Calculate the total cigarettes sold by summing the Non-Fee Brands and Fee Brands sales. This total should be entered in the designated field.

- If applicable, enter any totals from the previous page into the designated space on this form.

- Ensure accuracy in your calculations before proceeding to submit the form.

- Once the form is filled out, users can save changes, download the completed form, print it for physical records, or share it as necessary.

Complete your CT201-C form online today to ensure timely and accurate reporting of out-of-state cigarette sales.

New York again claims the top spot for the highest state cigarette excise tax, currently set at $4.35 per pack. This tax structure plays a pivotal role in shaping consumer behavior and market dynamics. Minnesota distributors involved in CT201-C, Out-of-State Cigarette Sales should stay informed about these high tax states to effectively strategize their operations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.