Loading

Get Alternative Minimum Tax 2012 - Minnesota Department Of Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Alternative Minimum Tax 2012 - Minnesota Department Of Revenue online

Filling out the Alternative Minimum Tax (AMT) for 2012 can be a straightforward process when you have a clear guide. This document will help you navigate the necessary steps to efficiently complete the form online.

Follow the steps to accurately complete the AMT form.

- Click ‘Get Form’ button to obtain the form and open it in your online editor.

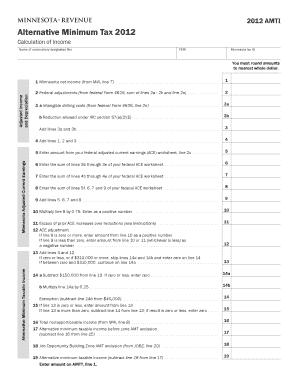

- Begin by entering the name of the corporation or the designated filer at the top of the form.

- Provide the Federal Employer Identification Number (FEIN) and your Minnesota tax ID in the designated fields.

- For line 1, enter your Minnesota net income as reported from Form M4I, line 7.

- Next, for line 2, input your federal adjustments calculated from Federal Form 4626, summing lines 2a - 2k and line 2o.

- For lines 3a and 3b, enter any intangible drilling costs and reductions allowed under IRC section 57(a)(2)(E) as applicable.

- Add the results from lines 3a and 3b, and record the total on line 3.

- Sum up the values from lines 1, 2, and 3, and enter the result on line 4.

- Input your amount from the federal adjusted current earnings (ACE) worksheet on line 5.

- Enter the sum from lines 3b through 3e of your federal ACE worksheet on line 6.

- Then, for line 7, enter the sum of lines 4b through 4e of your federal ACE worksheet.

- For line 8, record the sum of lines 5f, 6, 7, and 9 from your federal ACE worksheet.

- Add lines 5, 6, 7, and 8 together for line 9. Then multiply this total by 0.75 for line 10.

- Complete line 11, entering the excess of prior ACE increases over reductions as indicated.

- Proceed to line 12, which requires you to enter the ACE adjustment based on earlier calculations.

- For line 13, add lines 4 and 12. If the result is zero or more but under $310,000, continue to lines 14a and 14b.

- On line 14a, subtract $150,000 from line 13. If the result is less than zero, enter zero.

- For line 14b, multiply the value from line 14a by 0.25.

- Calculate the exemption for line 14 by subtracting line 14b from $40,000.

- Complete line 15 following the provided guidelines depending on the values from previous lines.

- Fill in line 16 as your total nonapportionable income from Form M4I, line 8.

- Calculate line 17 by subtracting line 16 from line 15.

- Enter any Job Opportunity Building Zone AMT exclusion amount on line 18.

- Finally, for line 19, subtract line 18 from line 17 to determine your alternative minimum taxable income.

- Once finished, review your entries for accuracy. You can save changes, download, print, or share the completed form.

Complete your Alternative Minimum Tax form online today for accurate reporting and compliance.

Yes, you can recoup AMT through specific tax credits and deductions in the following tax years. The recoupment process often requires detailed documentation and an understanding of tax regulations set out by the Minnesota Department Of Revenue. Utilizing resources such as uslegalforms can help clarify the steps needed to effectively manage and recoup AMT.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.