Loading

Get 2011 Ks, Shareholder's Share Of Income, Credits And Modifications

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 KS, Shareholder's Share Of Income, Credits And Modifications online

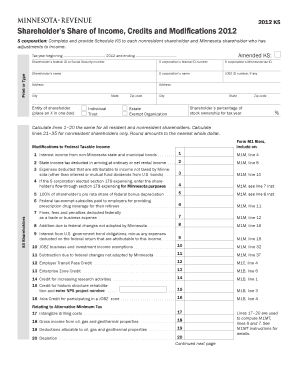

This guide provides clear, step-by-step instructions on how to complete the 2011 KS form, which reports each shareholder's share of income, credits, and modifications for tax purposes. Following these instructions will help ensure accurate filing and compliance with Minnesota tax regulations.

Follow the steps to successfully complete the 2011 KS form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the tax year in the designated fields. Fill in the beginning date and ending date for the tax year as indicated.

- Input the shareholder’s federal ID or Social Security number, as well as the S corporation’s federal ID number in the appropriate sections.

- Provide the S corporation's Minnesota tax ID. Enter the shareholder’s and S corporation’s names and addresses.

- Mark the box corresponding to the entity of the shareholder: Individual, Trust, Estate, or Exempt Organization.

- Declare the shareholder’s percentage of stock ownership for the tax year in the designated field.

- Follow the instructions for Modifications to Federal Taxable Income, starting with line 1 for interest income and proceeding through to line 12.

- Report Minnesota source gross income and ordinary Minnesota source income or loss as specified in the form.

- Complete modifications specific to nonresident shareholders, including any Minnesota composite income tax or nonresident withholding details.

- Review the entire document for completeness and accuracy. Finally, save your changes, download, print, or share the completed form as required.

Begin completing your documents online today!

Related links form

As of 2023, the sales tax rate in Minnesota is 6.875%. This rate applies to most purchases made in the state, but certain products may have different rates. Knowing the sales tax can help you plan your budget more accurately when making purchases. Always consider how this tax impacts your overall spending.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.