Get Schedule M1lti, Longterm Care Insurance Credit 2012 Sequence #15 Your First Name And Initial Last

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule M1LTI, Long-Term Care Insurance Credit 2012 online

Filling out the Schedule M1LTI is an essential step for those who have paid for qualifying long-term care insurance policies in 2012. This guide will walk you through each section and field of the form with clear instructions to ensure you can accurately submit your information online.

Follow the steps to successfully complete your Schedule M1LTI form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your first name, middle initial, and last name in the designated fields to ensure your identity is correctly reflected on the form.

- Enter your Social Security number in the appropriate field. Ensure that it is accurate to prevent any processing delays.

- If you or your partner paid premiums in 2012 for a qualified long-term care insurance policy, indicate this on the form. Check that the policy meets the qualifying criteria mentioned in the form.

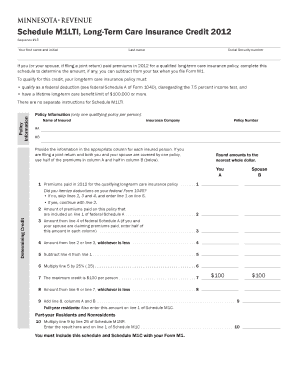

- Fill in the 'Policy Information' section with the name of the insured, the insurance company, and the policy number. Only one qualifying policy needs to be listed.

- In the 'Determining Credit' section, enter the total premiums paid in 2012 for the qualifying long-term care insurance policy in Line 1.

- Respond to the question regarding whether you itemized deductions on your federal Form 1040. Based on your answer, proceed accordingly to fill in the relevant lines.

- Follow the subsequent prompts to calculate your credit, rounding amounts to the nearest whole dollar as specified.

- Once all calculations are complete, check that the total amount from line 9 is entered correctly, especially if you are a part-year resident or nonresident.

- Finally, review all entries for accuracy and completeness, then save changes, download, print, or share the completed form as necessary.

Start filling out your Schedule M1LTI form online today!

The Minnesota tax credit for long-term care insurance is a tax break available to policyholders who invest in long-term care coverage. This credit minimizes your taxable income and acknowledges the importance of preparing for future healthcare needs. By taking advantage of the Schedule M1LTI, LongTerm Care Insurance Credit 2012 Sequence #15 Your First Name And Initial Last, you can strengthen your tax position while ensuring better care options in the future.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.