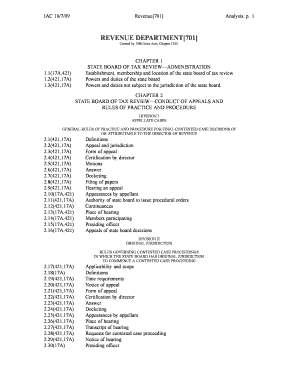

Get Establishment, Membership And Location Of The State Board Of Tax Review

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the establishment, membership and location of the state board of tax review online

This guide offers a clear, step-by-step approach to successfully completing the establishment, membership and location of the state board of tax review form online. Designed for users with varying levels of experience, this resource aims to simplify the process and ensure accurate submissions.

Follow the steps to complete the form efficiently.

- Press the ‘Get Form’ button to obtain the form and access it in the editor.

- Begin by filling out the establishment section. Include the name of the state board of tax review and any relevant historical details regarding its formation.

- In the membership section, provide information about the current board members, including their names, roles, and any other pertinent details. Make sure to check for accuracy.

- The location section requires the physical address where the board convenes. Ensure this information is complete, including any room or suite numbers.

- Review all sections for completeness and correctness to avoid any errors that may delay processing.

- Once you have confirmed that all information is accurate, you can save the changes to your document.

- Finally, choose to download, print, or share the form as necessary to complete your submission.

Get started now and complete your document online!

In New York, assessors have the authority to enter properties for assessment purposes, but they typically must provide notice. However, knowing your rights as a homeowner is essential. Should you have specific concerns about property assessments, consulting the establishment, membership, and location of the State Board of Tax Review can clarify your rights and responsibilities. This knowledge can help you engage effectively with assessors.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.