Get Obtaining A Cpa License Transfer Of Grades

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

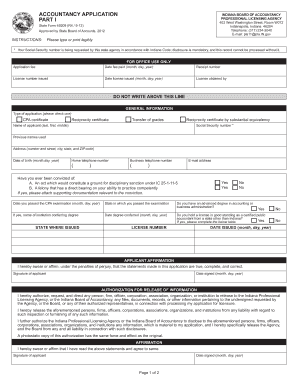

How to fill out the obtaining a CPA license transfer of grades online

This guide provides a comprehensive overview of the process involved in completing the obtaining a CPA license transfer of grades form online. Follow the instructions carefully to ensure a smooth submission and adherence to requirements.

Follow the steps to successfully complete the obtaining a CPA license transfer of grades form online.

- Press the ‘Get Form’ button to access the obtaining a CPA license transfer of grades form and open it in your preferred editor.

- Fill out your general information accurately. This includes your name, address, date of birth, and social security number. Ensure all sections are completed; if a question does not pertain to you, write ‘N/A’ or ‘none’.

- Select 'Transfer of Grades' in the type of application section. It is crucial to indicate your intent clearly.

- In the applicant affirmation section, read the statements provided and sign and date the document to affirm the truth of the information you supplied.

- Complete the authorization for release of information. Sign and date this section to allow verification of your information by relevant authorities.

- Move to part 2 of the State Form 49209. Here, provide details of your prior CPA license if applicable. List prior employers and the duration of your employment.

- Complete the CPA verification of experience form. Ensure that a licensed CPA fills out the second section and includes notarization.

- Double-check all entered information for accuracy and clarity. Use the auto-fill feature to ensure legibility where possible.

- Save your changes, then download or print the completed forms for your records.

- Submit your forms along with the required application fee to the Indiana Professional Licensing Agency, as specified in the instructions.

Begin your journey to obtaining your CPA license by completing the required documents online today.

To obtain a US CPA license, you typically need to complete 150 credit hours of education, pass the Uniform CPA Exam, and fulfill state-specific work experience requirements. Each state has its own guidelines, so it is crucial to understand what's required where you plan to practice. Start by researching your state's requirements, and consider using resources like uslegalforms to help with the steps needed for obtaining a CPA license transfer of grades.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.