Loading

Get Application For Retirement Annuity (pension) - State ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the APPLICATION FOR RETIREMENT ANNUITY (PENSION) online

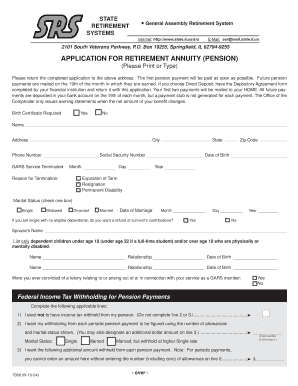

Filling out the application for retirement annuity is a crucial step in securing your pension benefits. This guide provides a comprehensive, step-by-step approach to assist users in successfully completing the form online.

Follow the steps to fill out your application accurately.

- Click ‘Get Form’ button to obtain the application form and open it for editing.

- Begin by printing or typing your name, address, and phone number in the designated fields. Ensure that the information is current and accurate.

- Indicate whether your GARS service has been terminated by checking 'Yes' or 'No.' Then provide your social security number and the date of birth in the specified format.

- Select the reason for your termination and indicate your marital status by checking the appropriate box. If married, please enter your marriage date.

- If you are single and have no eligible dependents, indicate if you want a refund of survivor's contributions by checking 'Yes' or 'No.'

- List dependent children under age 18 or over age 18 who are disabled, including their names, relationships, and birthdates.

- Respond to the felony conviction question by selecting 'Yes' or 'No.'

- For federal income tax withholding, choose one of the three options provided regarding tax withholding preferences. Complete the necessary information for your selection.

- If applying for permanent disability retirement, provide details about your permanent disability and the attending physicians' names and addresses.

- Indicate whether you have service credits in reciprocal retirement systems by selecting 'Yes' or 'No,' and list any relevant dates of service.

- Certify the accuracy of the information by signing and dating the application at the bottom of the form.

- After filling out all sections, save your changes, download the completed form, print it, or share it as needed.

Complete your APPLICATION FOR RETIREMENT ANNUITY (PENSION) online today!

As a pensioner in the UK, your personal tax allowance currently allows you to earn up to £12,570 without paying income tax. If your total income exceeds this allowance, then you will be subject to income tax on the excess amount. Understanding these thresholds is key to managing your finances effectively. Keep this in mind while processing your application for retirement annuity (pension) - State.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.