Get Households Are Allowed Certain Deductions From Gross Income When

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Households Are Allowed Certain Deductions From Gross Income When online

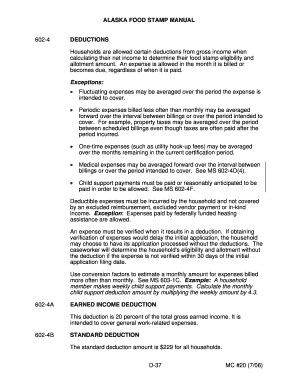

Filling out the Households Are Allowed Certain Deductions From Gross Income When form can be an essential part of determining eligibility for food stamp benefits. This guide will provide you with clear instructions and insights to ensure you complete the form accurately and efficiently.

Follow the steps to complete the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in your browser.

- Begin by providing your household's gross income details. Ensure all income sources are reported accurately and completely.

- Identify and list all allowable deductions from your gross income. This includes expenses such as medical costs, child support payments, and dependency-related care expenses.

- For each deduction, provide the corresponding monthly amounts. Make sure to follow the guidelines on how to calculate the average monthly amounts for any irregular or periodic expenses.

- Verify your deductions with appropriate documentation. This may include receipts, bills, or statements that support your expense claims.

- Review all details provided to ensure accuracy and completeness. Correct any errors or omissions before proceeding.

- Once you have completed all sections of the form, save your changes. You can then choose to download or print the completed form for your records.

Complete your documents online today to ensure accurate processing of your benefits.

You can deduct various expenses from gross income, including interest on student loans, certain business expenses, and qualified medical expenses. Each deduction has specific requirements, meaning households are allowed certain deductions from gross income when they align with these rules. Thoroughly understanding which deductions apply to your situation can help optimize your tax return.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.