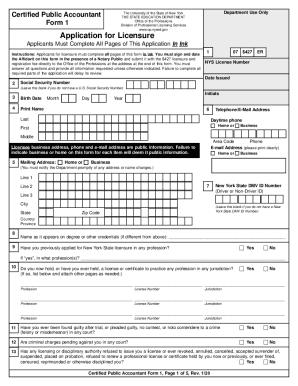

Get University Of The State Of New York Certified Public Accountant Form 1 Application For Licensure 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the University Of The State Of New York Certified Public Accountant Form 1 Application For Licensure online

This guide provides a systematic approach to completing the University Of The State Of New York Certified Public Accountant Form 1 Application For Licensure online. Following these instructions will help ensure that you accurately submit your application without delays.

Follow the steps to effectively complete the application form.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Fill in your personal information, including your name, Social Security Number (if applicable), date of birth, and contact details. Be sure to indicate whether the mailing address is home or business, as this information will be publicly available.

- Indicate your education background by listing the name and address of schools attended, the major/concentration of your studies, duration of attendance, degrees awarded, and their respective dates. Ensure that all required details are provided to avoid application incompleteness.

- Complete the experience history section by recording employment details relevant to the experience requirement. Ensure to list job titles, duration of employment, and whether the positions were part-time or full-time.

- Respond to the questions concerning criminal history and prior licenses. If applicable, provide detailed explanations for any affirmative answers, along with supporting documentation as needed.

- Provide information regarding your route to licensure, including the number of semester hours or experience you possess, and if applicable, indicate your choice of endorsement.

- Review and acknowledge your compliance with child support obligations by selecting the appropriate statement.

- Complete the citizenship/immigration status section by checking the relevant category based on your situation, writing your alien registration number if applicable.

- Take note of the optional gender and ethnicity section for statistical purposes, providing this information if you choose.

- End with the notarization section. Sign and date the affidavit in the presence of a Notary Public, ensuring all signatures are complete and accurate.

- Once the form is filled out, review all information for accuracy before saving changes. You can then download, print, or share the completed form as needed.

Complete your application for licensure online today for a smooth and efficient submission process.

The pass rate for the CPA exam in New York fluctuates each year, typically ranging between 50% to 60%. This means that preparation is key to success. Many candidates benefit from structured study programs and adhering closely to the University Of The State Of New York Certified Public Accountant Form 1 Application For Licensure to ensure they meet all necessary requirements. Staying informed about exam trends can also enhance your chances.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.