Loading

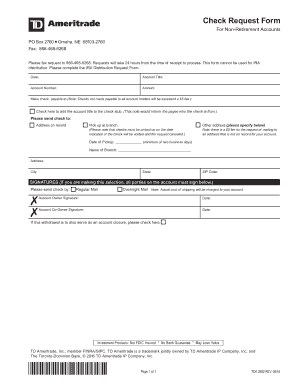

Get For Non-retirement Accounts

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the For Non-Retirement Accounts online

Filling out the For Non-Retirement Accounts form is essential for requesting checks or withdrawals from your account. This guide provides clear, step-by-step instructions to ensure a smooth online submission process.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it to begin the filling process.

- Enter the date in the provided field. This ensures that your request is processed in a timely manner.

- Fill in the account title, which denotes the name associated with the account you wish to access.

- Input the account number accurately. This identification is vital for processing your request.

- Specify the amount you are requesting, making sure to follow any guidelines regarding the minimum and maximum allowable amounts.

- Indicate how you would like the check to be made payable. Ensure that checks are made out to all account holders to avoid additional fees.

- If preferred, check the box to add the account title to the check stub for clarity on the source of the funds.

- Select your preferred sending method for the check: either to the address on record or to a different address, if needed. If you choose a different address, provide that information clearly.

- If you plan to pick up the check at a branch, make sure to include the name of the branch and the required minimum two business days for pickup.

- Gather all necessary signatures for the request. If there are co-owners, ensure they sign as well.

- Choose your mailing preference: Regular Mail or Overnight Mail and note that overnight delivery costs will be charged to your account.

- If this request serves as an account closure, check the indicated box.

- After completing the form, you can save changes, download, print, or share the form as needed.

Complete your documents online today for efficient processing.

Yes, you can withdraw funds from a non-retirement account without facing penalties, which is a significant advantage of these accounts. Unlike retirement accounts, withdrawals from non-retirement accounts can happen at any time, granting you easier access to your funds. However, keep in mind that capital gains taxes may apply to your withdrawals, depending on the type of investments held within the account.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.