Get If Wanting To Designate Beneficiaries For A Non-ira Account, Please Submit A Transfer On Death

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the If Wanting To Designate Beneficiaries For A Non-IRA Account, Please Submit A Transfer On Death online

Designating beneficiaries for a non-IRA account is an important step in ensuring your assets are distributed according to your wishes. This guide will provide you with clear instructions on how to complete the Transfer on Death Agreement Beneficiary (TOD) Agreement form online.

Follow the steps to successfully fill out and submit your form.

- Click the ‘Get Form’ button to access the Transfer on Death Agreement Beneficiary form. Once you have clicked, it will open in an editable format allowing you to begin filling it out.

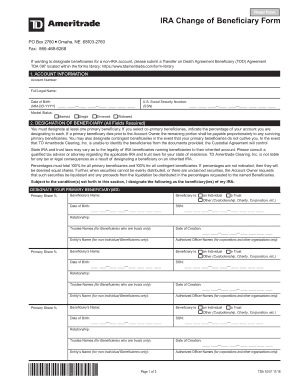

- Fill in the account information section. Provide your account number, full legal name, date of birth, marital status, and U.S. Social Security number. Ensure all information is accurate to avoid processing delays.

- Designate your primary beneficiaries. You are required to name at least one primary beneficiary and indicate what percentage of your account each will receive. If selecting co-primary beneficiaries, make sure the total shares equal 100%.

- If applicable, provide the details for contingent beneficiaries, including their names and share percentages. This ensures that if the primary beneficiaries do not survive you, the assets will go to those designated as backups.

- Review the community property section if you reside in a community property state. If you are married and not naming your spouse as the sole primary beneficiary, obtain their consent and signature.

- Sign the form in the designated area, ensuring you include the date. Remember that electronic signatures are not authorized; an original signature is required.

- Finally, submit the completed form along with a copy of your current government-issued photo ID or have it stamped by a TD Ameritrade branch. You may choose to save changes, download, print, or share the document after completion.

Complete your Transfer on Death Agreement Beneficiary form online today to ensure your beneficiaries are properly designated.

While Transfer on Death designations offer advantages such as avoiding probate, there are some disadvantages to be aware of. These include potential conflicts among beneficiaries and the inability to control distributions after your passing. If wanting to designate beneficiaries for a non-IRA account, please submit a Transfer on Death, but also consider these factors to make informed decisions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.