Loading

Get 2024 Nl Form 7147

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2024 NL Form 7147 online

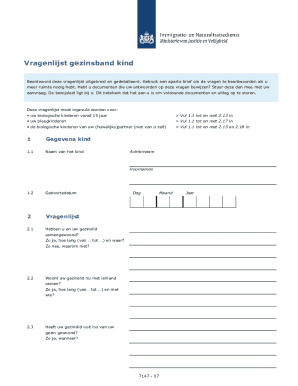

Filling out the 2024 NL Form 7147 online is a straightforward process that helps you provide essential information about your family connections. This guide will walk you through each section and field, ensuring that your submission is complete and accurate.

Follow the steps to successfully fill out the 2024 NL Form 7147 online.

- Click the ‘Get Form’ button to access the form and open it in your document editor.

- Begin with section 1, which requires details about the child. Fill in their last name and first names in the specified fields.

- Provide the child's date of birth in the format requested, ensuring accuracy.

- Move to section 2, starting with question 2.1. Indicate whether the family member has lived with you, and if so, detail the duration and location.

- For question 2.2, specify if the family member currently lives with someone else and provide the duration and who they live with.

- Complete question 2.3 by addressing whether the family member has ever lived apart from the family, and provide the relevant dates.

- Proceed to question 2.4, stating if the family member has ever been in a relationship or married, including dates and partner's information.

- In question 2.5, indicate if the family member has had paid employment and describe the type of work.

- For question 2.6, mention if the family member received financial support in any other forms and elaborate on how.

- Complete question 2.7 by explaining if the family member had enough income for basic needs, such as food and shelter.

- Questions 2.8.a to 2.8.e focus on financial support details. Confirm if the family member is dependent on you for costs, and provide supporting documents if applicable.

- Answer whether the family member has established their own household in question 2.9.

- Address dependencies for questions 2.11.a and 2.11.b highlighting if there is any financial, medical, or emotional reliance.

- In question 2.12.a, indicate if the family member has completed military service, providing details about the service.

- For the questions specific to foster children in sections 2.14 to 2.17, provide information about the foster relationship and any involvement of biological parents.

- If applicable, fill in section 2.18 for biological children of your partner, detailing their inclusion in your household.

- Once you have filled out all relevant sections, review your entries for accuracy and completeness.

- Finally, save your changes, and you can download, print, or share the completed form as required.

Take action now and complete your 2024 NL Form 7147 online for a seamless submission.

Yes, US expats are generally required to file taxes regardless of where they live. This obligation ensures that you report your worldwide income to the IRS. Filing helps you stay in good standing with US tax laws, and you may also qualify for various exclusions and credits. Utilizing the 2024 NL Form 7147 can help you navigate your tax responsibilities efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.