Loading

Get 2024 Es Atc S652 (spain)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2024 ES ATC S652 (Spain) online

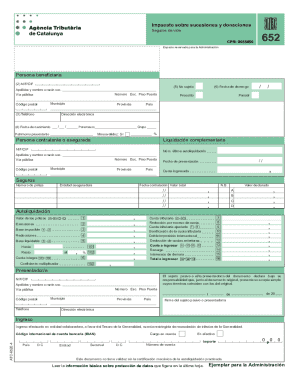

The 2024 ES ATC S652 form is essential for reporting inheritance and donation taxes in Spain. This guide will provide you with clear, detailed steps to effectively complete the form online, ensuring you fulfill your obligations accurately.

Follow the steps to complete the form with ease.

- Press the ‘Get Form’ button to retrieve the form and open it in your preferred editor.

- Begin by filling in the 'persona beneficiaria' section, which includes fields for the tax identification number (NIF/CIF), name, and surname of the beneficiary. Ensure that you enter accurate information.

- Enter the beneficiary's contact details, including the complete address, telephone number, postal code, province, and country.

- Provide the beneficiary’s date of birth, relationship to the deceased, and any applicable disability percentage.

- Complete the section for the insurance policy, which requires details such as the insurance policy number, insurer, and contract date. Enter values related to the coverage and existing estate.

- Proceed to calculate the tax. Fill in the relevant values for exemption and applicable reductions, and compute the taxable base.

- Detail your tax rate and multipliers based on the computed standards to arrive at the final amount due.

- Once all sections are completed, review all entries for accuracy and save the draft. You can choose to download, print, or share the completed form.

Complete your documents online today to ensure timely submission.

In Spain, the tax authorities can audit your financial records for up to four years for most tax issues, but this period can extend to six years for serious offenses. It is vital to maintain accurate records, particularly if you are preparing for the 2024 ES ATC S652 (Spain). By staying organized and informed, you can mitigate the risks associated with potential audits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.