Loading

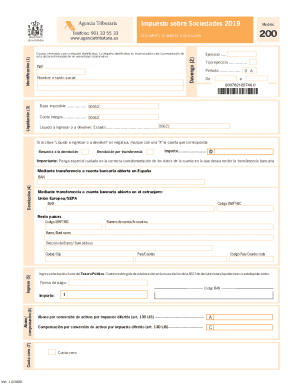

Get 2019 Es Modelo 200

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2019 ES Modelo 200 online

The 2019 ES Modelo 200 is a crucial form for corporate tax declaration in Spain. This guide provides a comprehensive walkthrough on how to fill out the form online, ensuring accuracy and compliance.

Follow the steps to accurately complete the 2019 ES Modelo 200 online.

- Click the 'Get Form' button to obtain the form and open it in your preferred digital editor.

- Fill in the identification section. Enter the NIF (tax identification number) and the name or corporate name in the designated fields.

- In the fiscal year section, specify the year of exercise and the period relevant to your tax situation.

- Complete the liquidation section. Input the taxable base amount in the corresponding field and the total tax due in the gross quota field.

- Indicate whether there is a liquid amount payable or to be refunded. If applicable, check the appropriate box if renouncing the refund.

- For refunds, provide accurate banking details where you wish to receive your transfer, including IBAN for accounts in Spain or in the European Union.

- Ensure that information regarding any payments made to the public treasury is precisely filled out, noting the payment method and IBAN.

- Review all information entered for accuracy and completeness. Once confirmed, you can save, download, print, or share the completed form as needed.

Start filling out your 2019 ES Modelo 200 form online today for a seamless submission.

Model 200 is a tax form in Spain used for corporate income tax returns filed by businesses and companies. It includes the financial results of the previous fiscal year and is essential for ensuring compliance with tax regulations. Knowing how the 2019 ES Modelo 200 fits into your corporate planning can enhance your financial strategy. Uslegalforms offers tools and guidance to ensure that you fulfill your corporate tax obligations effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.