Loading

Get 2013 Es Atc S21 (catalan)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

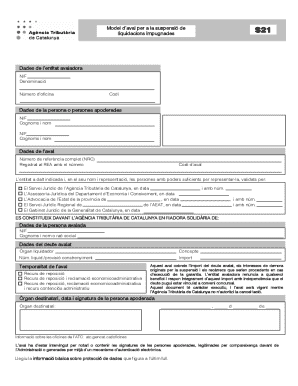

How to fill out the 2013 ES ATC S21 (Catalan) online

Filling out the 2013 ES ATC S21 form online is an essential step for individuals and entities seeking to manage tax obligations effectively. This guide will provide you with clear, step-by-step instructions to help you complete the form accurately and hassle-free.

Follow the steps to successfully complete the form

- Press the ‘Get Form’ button to obtain the form and open it in your preferred online editing tool.

- In the first section titled 'Dades de l’entitat avaladora,' enter the details of the guarantor entity. This includes the NIF (tax identification number), the name of the entity, the office number, and the code associated with the guarantor.

- Next, move to the section 'Dades de la persona o persones apoderades' where you should provide the NIF and the full names of the authorized persons representing the entity. If more than one person is authorized, ensure to fill in all respective fields.

- In the 'Dades de l’aval' section, include the complete reference number (NRC) previously registered with the tax agency. Also, input the relevant information for each validated legal service, detailing the respective entity and date.

- Continue to 'Dades de la persona avalada' section to fill in the NIF and the name or social reason of the person being guaranteed.

- Proceed to the 'Dades del deute avalat' section where you will record the liquidation agency, concept, and details of the debt including the number of the liquidation or enforcement provision and the total amount owed.

- Specify the 'Temporalitat de l’aval' by indicating the type of recourse being claimed, whether it is a simple replacement, a replacement with economic-administrative claim, or includes both a replacement and administrative contentious resource.

- Fill in the section designated for the recipient agency, the date, and the signature of the authorized person representing the guarantor entity.

- Before finalizing, read through the basic information regarding data protection provided at the end of the form. Ensure your entries are accurate and complete.

- Finally, save your changes, download the completed form, and ensure to print a copy if necessary for your records or to share as needed.

Complete your 2013 ES ATC S21 form online today for efficient management of your tax obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.