Loading

Get 2018 Es Atc S13 (spain)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2018 ES ATC S13 (Spain) online

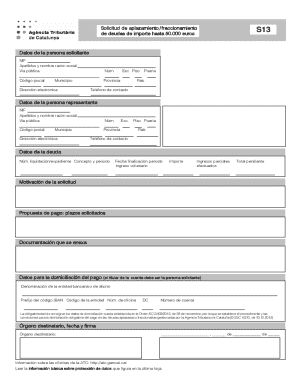

This guide provides clear instructions on how to complete the 2018 ES ATC S13 form online. The form is essential for individuals requesting the postponement or installment of debts up to 50,000 euros with the Agencia Tributaria de Cataluña.

Follow the steps to seamlessly complete your application.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill out the 'Datos de la persona solicitante' section, including your NIF (tax identification number), last name and first name or social reason, public thoroughfare, number, postal code, province, municipality, electronic address, building information, country, and contact phone number.

- Complete the 'Datos de la persona representante' section if applicable. Provide the representative's NIF, last name and first name or social reason, public thoroughfare, number, postal code, province, municipality, electronic address, building information, country, and contact phone number.

- In the 'Datos de la deuda' section, enter the liquidation/expedient number, the concept and period of the debt, the end date of the voluntary payment period, the amount due, any partial payments made, and the total pending amount.

- Add your motivation for the request in the 'Motivación de la solicitud' field. Clearly explain why you are requesting the deferment or installment of the debt.

- Provide your proposed payment plan in the 'Propuesta de pago: plazos solicitados' section. Specify how you wish to pay the requested installments.

- Indicate any documents you are attaching to support your application in the 'Documentación que se anexa' field.

- Complete the payment domiciliation information section by detailing the banking institution's name, IBAN prefix, entity code, office number, control digit, and account number. Ensure that the account holder is the applicant.

- Finally, add the recipient authority, the date, and your signature at the end of the form.

- Once all fields are completed, save changes, and choose to download, print, or share the form as needed.

Start filling out your 2018 ES ATC S13 form online to manage your debts effectively.

Becoming a tax resident in Spain typically requires you to reside in the country for more than 183 days within a calendar year. You’ll need to register with the local authorities and obtain a tax number. Understanding the nuances of the 2018 ES ATC S13 (Spain) can help ensure that your transition to tax residency is smooth and compliant.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.