Loading

Get 2012 De Erbschaftsteuererklarung

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

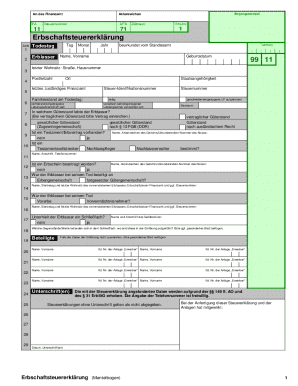

How to fill out the 2012 DE Erbschaftsteuererklarung online

Filling out the 2012 DE Erbschaftsteuererklarung can be straightforward with comprehensive guidance. This guide will provide step-by-step instructions for completing the form online, ensuring that all relevant information is captured accurately.

Follow the steps to complete the Erbschaftsteuererklarung form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the information regarding the deceased's date of death, including day, month, and year, as well as the certified official information from the civil registry office.

- Enter the deceased's name, date of birth, last residence address, postal code, city, nationality, and the last responsible tax office.

- Indicate the tax identification number of the deceased, as well as their marital status at the time of death—options include single, married, widowed, or divorced.

- Provide details about the deceased’s estate, including the legal marital property regime, if applicable.

- If a will or inheritance agreement exists, indicate whether there is an executor, estate administrator, or other responsible parties, and provide their details.

- Describe any assets held in safety deposit boxes, including information about the bank and the contents of the box.

- Compile a list of all assets and their values in accordance with the categories on the form, including agricultural properties, business assets, and other valuable properties.

- Enter any liabilities of the deceased, such as loans or taxes owed, along with details of creditors and outstanding amounts.

- Complete the section for funeral and estate management costs if they exceed the threshold value of €10,300.

- Indicate any legacies, conditions, or claims arising from the estate, along with specific amounts and relevant parties involved.

- Review all entered information for accuracy before submitting the form. Ensure all necessary documents, attachments, and signatures are included.

- Once completed, the form can be saved, downloaded, printed, or shared as needed.

Start filling out your 2012 DE Erbschaftsteuererklarung online today to ensure accurate and timely submissions.

Alle Vermögenswerte, die im Nachlass des Verstorbenen vorhanden sind, unterliegen der Erbschaftsteuer. Dazu zählen Immobilien, Bankkonten, Wertpapiere und persönliche Gegenstände. Um die 2012 DE Erbschaftsteuererklarung korrekt einzureichen, sollte jedes Vermögen dokumentiert werden. Ein klar erstelltes Verzeichnis hilft, Transparenz zu wahren und Steuerschwierigkeiten zu vermeiden.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.