Loading

Get Department Of The Treasury Internal Revenue Service Omb No

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

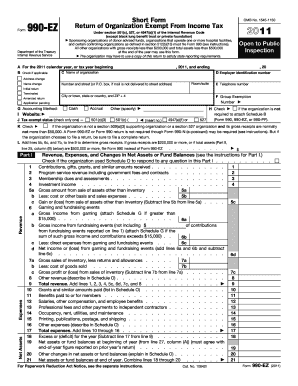

How to fill out the Department Of The Treasury Internal Revenue Service OMB No 990-EZ online

Filling out Form 990-EZ is an essential step for organizations exempt from income tax under section 501(c) that meet specific criteria. This guide provides clear, step-by-step instructions to ensure users can easily complete the form online.

Follow the steps to complete the Form 990-EZ effortlessly.

- Click ‘Get Form’ button to download the form and open it in your preferred document editor.

- Enter the calendar year for which you are filing the return in the field labeled 'For the calendar year, or tax year beginning ... and ending ...'.

- Provide the organization's name in the 'Name of organization' field. Ensure it matches the legal name on your IRS records.

- Check any applicable boxes, including changes in name or address, and state whether this is an initial, terminated, or amended return.

- Fill in the Employer Identification Number (EIN) in the designated area.

- Indicate the organization’s accounting method by selecting either 'Cash,' 'Accrual,' or 'Other' and specify if you chose 'Other.'

- Select the appropriate tax-exempt status by checking the box corresponding to 501(c)(3), 501(c)(4), or 4947(a)(1).

- Complete Part I by entering the revenue, expenses, and changes in net assets or fund balances. Report figures in the respective lines carefully.

- Proceed to Part II to fill out the balance sheet, detailing both beginning and end of year asset entries.

- In Part III, write down the organization’s primary exempt purpose and describe the program service accomplishments.

- List all officers, directors, trustees, and key employees in Part IV, including their titles and compensation details.

- Address the miscellaneous questions in Part V and ensure to provide any necessary explanations in Schedule O.

- Review your completed form for accuracy and ensure all required fields are filled out appropriately.

- Finally, save your changes, and once finalized, download or print the form for submission as required.

Start completing your Form 990-EZ online today to ensure your organization remains compliant with IRS regulations.

To look up an OMB number, you can visit the official OMB website or access IRS resources that provide listings of approved forms. The Department of the Treasury Internal Revenue Service also includes OMB numbers on the relevant forms themselves. Using these resources can help you find the right number quickly and ensure your forms are completed correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.