Loading

Get Userid: Pager/sgml Page 1 Of 21 Fileid: Dtd Instr04 Leadpct: 0% Pt - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Userid: PAGER/SGML Page 1 Of 21 Fileid: DTD INSTR04 Leadpct: 0% Pt - Irs online

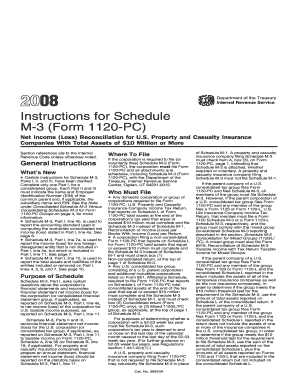

This guide provides a clear and comprehensive overview of how to fill out the Userid: PAGER/SGML Page 1 Of 21 Fileid: DTD INSTR04 Leadpct: 0% Pt - Irs form. Follow the outlined steps to ensure accurate completion of each section and field.

Follow the steps to efficiently complete the form.

- Press the ‘Get Form’ button to access the document in the editor.

- Carefully read through the general instructions provided in the document. Understanding the context and purpose of the form is essential before filling it out.

- Identify the required information for Part I, which includes details about your corporation’s financial statements and net income reconciliation. Gather prior financial records if needed.

- Complete Part I by answering all applicable questions regarding the financial statements, ensuring to indicate the appropriate accounting standards used as necessary.

- If applicable, proceed to Parts II and III of the form, ensuring that you report the requisite financial figures and adjustments accurately.

- Review each section for completeness, ensuring all boxes are checked where required, particularly if filing for a consolidated or mixed group.

- Once all necessary information is correctly filled out, you can choose to save changes, download the document, print it for physical submission, or share it digitally as required.

Start filling out your form online to ensure timely compliance and accuracy.

To fill out a Schedule 1 form, first gather all necessary income and adjustment documents for the year. You will need to report additional income and adjustments to income, accurately filling in each relevant section. It's important to follow the instructions carefully to avoid mistakes that could delay your tax return. Additionally, resources like uslegalforms can provide tailored guidance to simplify this process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.