Loading

Get Number 201117032 - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Number 201117032 - IRS online

This guide provides comprehensive instructions on filling out Form 201117032 from the Internal Revenue Service. Whether you are a beginner or have some experience, this step-by-step approach will help you navigate the online process effectively.

Follow the steps to accurately complete the form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Carefully read the instructions provided on the form. Understanding the purpose of the document and the information required will help you complete it accurately.

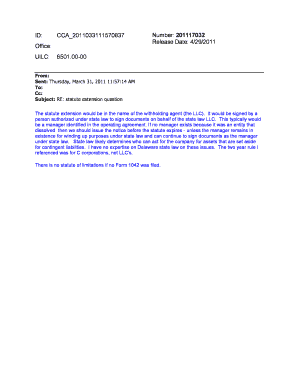

- Fill in the necessary identifying information. This may include details such as the name of the withholding agent and the tax identification number.

- Indicate any relevant dates related to the statute extension, ensuring that all entries are accurate and comply with the required format.

- If applicable, provide information about the party authorized to sign on behalf of the entity, including their relationship to the entity and any relevant authority.

- Review all filled fields for completeness and accuracy, ensuring that no sections are left blank unless specified.

- Once you have filled out the form and verified the information, you can save your changes, download a copy for your records, print, or share the form as needed.

Complete your documents online with confidence today!

The easiest way to fill out a tax return is to use a reliable online platform like US Legal Forms. This user-friendly service guides you through each step, ensuring you complete your return accurately. You can quickly access necessary documents and fill them out without confusion. Using tools like these helps you stay organized and meets the requirements of Number 201117032 - Irs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.