Loading

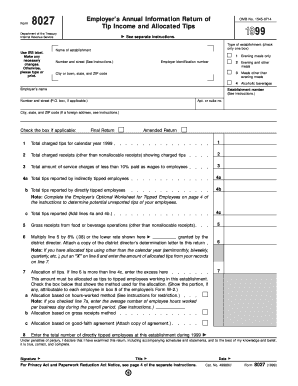

Get 1999 Form 8027. Employer's Annual Information Return Of Tip Income And Allocated Tips

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1999 Form 8027. Employer's Annual Information Return Of Tip Income And Allocated Tips online

This guide provides clear instructions for filling out the 1999 Form 8027, which is the Employer's Annual Information Return of Tip Income and Allocated Tips. Completing this form accurately helps ensure proper reporting of tip income and allocated tips for your establishment.

Follow the steps to fill out your form effectively.

- Click ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Identify your type of establishment by checking only one box: evening meals only, evening and other meals, meals other than evening meals, or alcoholic beverages.

- Enter the name of your establishment in the designated field.

- Provide your establishment’s street address, including number, street name, apartment or suite number (if applicable), city, state, and ZIP code.

- Include your employer identification number (EIN) in the specified field.

- Indicate whether this is a final return or an amended return by checking the appropriate box.

- Report the total charged tips for the calendar year 1999 in the corresponding field.

- Enter the total charged receipts (excluding nonallocable receipts) showing charged tips.

- Record the total amount of service charges of less than 10% that were paid as wages to employees.

- Complete lines 4a, 4b, and 4c to report tips received by indirectly tipped employees, directly tipped employees, and the total tips, respectively.

- Document the gross receipts from food or beverage operations in the designated space.

- Calculate the required allocation by multiplying the gross receipts by 8% or the lower rate provided. Attach the district director’s determination letter, if applicable.

- If applicable, complete line 7 by entering the amount of allocated tips, and check the box for the allocation method used: hours-worked, gross receipts, or good-faith agreement.

- Input the total number of directly tipped employees at the establishment during 1999.

- Sign and date the form, providing your title to certify the accuracy of the information provided.

Complete your Form 8027 online to ensure proper reporting of tip income and allocated tips.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.