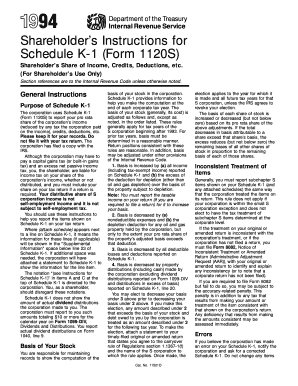

Get Department Of The Treasury Internal Revenue Service Shareholder S Instructions For Schedule K-1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Department of the Treasury Internal Revenue Service Shareholder's Instructions For Schedule K-1 online

Filling out the Department of the Treasury Internal Revenue Service Shareholder's Instructions For Schedule K-1 can be a critical step for shareholders looking to report their income accurately. This guide provides detailed instructions to make the process clear and accessible, even for those with limited legal experience.

Follow the steps to complete your Schedule K-1 accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the general instructions provided on the form to understand its purpose. Schedule K-1 is used to report your share of the corporation's income, credits, deductions, etc. Ensure you do not file it with your tax return, as the corporation will file a copy with the IRS.

- Fill out Item A with your name, address, and taxpayer identification number (TIN) as the shareholder. Check for accuracy to avoid issues.

- Complete the income and loss sections (lines 1 through 5) based on your share of the corporation's activities. Make sure to differentiate between ordinary income and any passive income, following the guidelines on how to report this income on your tax return.

- If applicable, fill out deductions (lines 7 through 10) that pertain to your share of the activities of the corporation. Be sure to follow the specific instructions related to passive activity losses.

- Report any tax credits you are entitled to (lines 12 through 13) based on the corporation's activities. Ensure each credit is recorded as instructed on the form.

- Review any supplemental information or attach statements as needed, as indicated in line 23. This may provide additional context for your income tax reporting.

- Double-check all entries for accuracy before concluding. Once confirmed, you can save your changes, download, or print the completed Schedule K-1.

Utilize this guide and complete your required documents online per IRS regulations.

Filing an S Corp election with the IRS involves completing Form 2553, which officially designates your corporation as an S Corporation. You'll need to gather necessary information, such as the tax year and stock ownership details. The Department Of The Treasury Internal Revenue Service Shareholder S Instructions For Schedule K-1 also provides relevant information for maintaining S Corp status after the election. If you need assistance, uslegalforms offers resources to ensure that you correctly file your election and related documents.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.