Loading

Get 1998 Form 5500 (schedule B) - Internal Revenue Service

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1998 Form 5500 (Schedule B) - Internal Revenue Service online

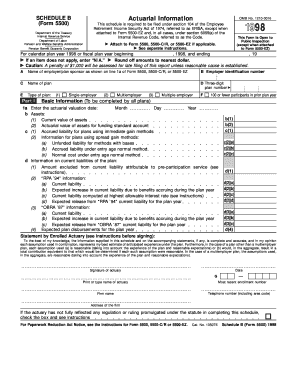

The 1998 Form 5500 (Schedule B) is essential for reporting actuarial information about employee benefit plans. This guide provides clear, step-by-step directions to assist users in completing the form accurately online.

Follow the steps to complete the 1998 Form 5500 (Schedule B) online.

- Press the ‘Get Form’ button to access the document and open it in your online editor.

- Begin by entering the name of the employer or plan sponsor as displayed on line 1a of Form 5500.

- Provide the Employer Identification Number (EIN) in field B.

- List the name of the plan in field C and its three-digit plan number in field D.

- Select the type of plan by checking one of the following options: Single employer (1), Multiemployer (2), or Multiple employer (3) in field E.

- Indicate if there were 100 or fewer participants in the prior plan year in field F.

- Complete Part I by entering the actuarial valuation date in 1a, followed by the current value and actuarial value of assets in 1b.

- Fill in pertinent liabilities and expected increases in current liabilities defined in section 1c and 1d.

- Review and confirm the information provided by the enrolled actuary in the designated signature area.

- Once all information is entered, save your changes, then choose to download, print, or share the completed form as needed.

Complete and submit your 1998 Form 5500 (Schedule B) online today to ensure accurate reporting.

To file your 5500, you must submit the necessary forms electronically to the Department of Labor, specifically through their EFAST2 system. The 1998 Form 5500 (Schedule B) - Internal Revenue Service should be attached as part of the overall filing for your pension plan. Using our U.S. Legal Forms platform can simplify this process, as it provides all the necessary documentation and guidance for a successful filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.