Loading

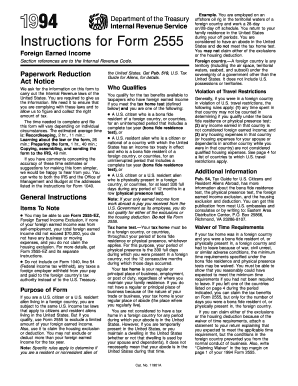

Get Paperwork Reduction - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Paperwork Reduction - IRS online

Filling out the Paperwork Reduction - IRS is essential for U.S. citizens or residents living abroad who wish to claim exclusions on foreign earned income. This guide provides a clear, step-by-step approach to complete the form accurately and efficiently.

Follow the steps to fill out the Paperwork Reduction - IRS online

- Press the ‘Get Form’ button to access the form and open it in your document editor.

- Read the general instructions provided at the top of the form to understand the purpose and requirements before you proceed.

- Fill in your personal information as requested, ensuring that your name and other identifying details are accurate.

- Identify if you qualify for the tax benefits by completing the necessary sections regarding foreign earned income and the tax home test.

- Complete Part IV by reporting your total foreign earned income, ensuring you include all relevant categories such as wages and salaries.

- Continue to Parts VI and VII where you will detail housing expenses and claim the appropriate deductions.

- Review the calculations based on your entries to ensure all amounts are accurately reported.

- Finalize the form by reviewing all sections for completeness and correctness, then save your changes.

- Download, print, or share the form as needed, making sure to keep a copy for your records.

Start completing your Paperwork Reduction - IRS form online today.

The number of withholding allowances you should claim depends on your specific financial situation, including dependents and tax obligations. You can estimate your allowances using the IRS worksheets provided with Form W-4. Adjusting this number accurately helps ensure that your tax withholdings meet your financial needs throughout the year, aligning with the Paperwork Reduction - Irs goal.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.