Loading

Get C:userswbietz.usbchtd1desktopdocsopen Involuntary ... - Ctb Uscourts

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the C:Userswbietz.USBCHTD1DesktopdocsOpen Involuntary ... - Ctb Uscourts online

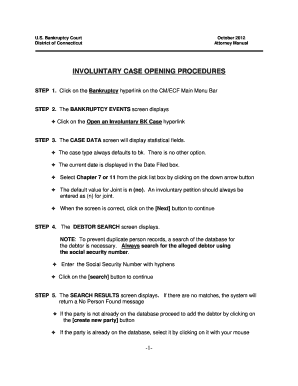

This guide provides a comprehensive overview of how to fill out the C:Userswbietz.USBCHTD1DesktopdocsOpen Involuntary ... - Ctb Uscourts form online. Whether you are familiar with legal documents or new to the process, this step-by-step guide will support you in completing the form correctly and efficiently.

Follow the steps to successfully complete the form online.

- Click the ‘Get Form’ button to obtain the form and open it in your editor of choice.

- On the Bankruptcy events screen, select the 'Open an Involuntary BK Case' hyperlink to begin the process.

- Fill out the case data screen, ensuring that the case type defaults to 'bk' and choose between Chapter 7 or 11 from the dropdown menu. Confirm that 'Joint' is marked as 'n'. Double-check your entries and proceed by clicking the [Next] button.

- On the Debtor Search screen, enter the alleged debtor's social security number with hyphens to prevent duplicate records and click [search].

- Review the search results. If no matches are found, click [create new party] to add the debtor. If matches are found, verify the party’s information and select it from the list by clicking [select name from list].

- Input the debtor’s name and address in the appropriate fields on the Debtor Information screen. Ensure that no special characters are used. Select the county of residence from the pick list.

- If the debtor has an alias, click the [alias] button to proceed with adding alias information.

- On the Alias screen, enter up to five alias records, selecting the appropriate alias role for each. Click [add aliases] after entering the information.

- At the Debtor Information screen, you can review the provided information by clicking the [review] button. If everything is correct, click the [return to party screen] button.

- Finalize the debtor information by clicking the [submit] button to continue the case opening process.

- Proceed to the Search Petitioning Creditor screen and enter the last name of the petitioning creditor, then click [search].

- Check the search results for matches. If found, verify the information and select it. If no matches exist, click [create new party] to add the creditor.

- On the Petitioning Creditor Information screen, fill in the necessary name and address fields and confirm your role as the filing attorney before clicking [submit].

- Continue adding petitioning creditors, or click on End Petitioning Creditor Selection if finished.

- On the Divisional Office Assignment screen, verify the divisional office. If incorrect, use the browser's back button to make corrections.

- Complete the Statistical Data screen by answering questions about prior filings, debtor type, fee status, nature of debt, estimated creditors, assets, and liabilities, and click [next].

- Upload necessary PDF documents by clicking the [browse] button and following the prompts to select and verify the file.

- Proceed to the Fee Information screen by clicking [next].

- Click [next] again to continue.

- Review the docket text for accuracy on the Docket Text Editing screen and make any necessary edits before clicking [next].

- Check the final docket text on the Final Docket Text screen, making sure all information is accurate before continuing.

- The Electronic Fee Payment screen will appear. Click 'Pay Now' or 'Continue Filing' to advance in the process.

- Enter your payment information and confirm the payment by clicking [continue]. Then review the Payment Summary and Authorization and enter your email address before completing the transaction.

- Finally, the Notice of Electronic Filing screen will confirm your submission with the case number, certifying that it has been filed electronically.

Begin your document filing process online today!

There is no set minimum debt amount required to file Chapter 7, but you must demonstrate an inability to repay your debts. Typically, individuals file when their debts exceed their assets and income. Each case is unique, and uslegalforms offers tools to help you evaluate your financial situation and decide if filing is the right path for you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.