Get Naic Uniform Suspected Insurance Fraud Reporting Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NAIC Uniform Suspected Insurance Fraud Reporting Form online

Filling out the NAIC Uniform Suspected Insurance Fraud Reporting Form online is a crucial step in reporting suspected fraudulent activities within the insurance industry. This guide will provide you with a clear, step-by-step approach to completing the form accurately and efficiently.

Follow the steps to complete the form successfully.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

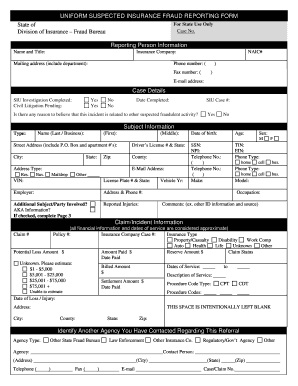

- Begin by entering your information in the 'Reporting Person Information' section. Include your name and title, the insurance company you are representing, mailing address, NAIC number, phone number, fax number, and email address.

- In the 'Case Details' section, indicate whether the Special Investigations Unit (SIU) investigation has been completed and if civil litigation is pending by selecting 'Yes' or 'No'. Provide the date of completion and the SIU case number.

- Complete the 'Subject Information' section with the details of the individual or entity involved. Fill in their name, date of birth, sex, street address, driver's license number, city, county, state, and zip code.

- Provide additional details including the type of address, email address, vehicle information (VIN and license plate), employer details, and reported injuries.

- In the 'Claim/Incident Information' section, include any relevant claims, policy numbers, insurance types, potential loss amounts, claim status, and dates of service. Be as specific as possible with the amounts and descriptions of services.

- Specify the agency you contacted regarding this referral in the 'Identify Another Agency' section. Include the agency type, contact person, and phone numbers.

- Indicate the evidentiary materials available, checking all applicable evidence types in the 'Evidence' section.

- In the 'Suspected Fraud Types' section, mark all applicable types of suspected fraud. This is a critical part to ensure proper categorization.

- If more space is required, attach additional pages for the 'Detailed Synopsis' to provide a comprehensive overview of suspected fraud.

- Finally, review all information for accuracy and completeness. Once confirmed, save your changes, download the document, print it, or share it as necessary.

Take the necessary steps to report suspected insurance fraud—complete your form online today!

The amount of evidence required to establish fraud can vary based on the case's specifics, but generally, significant corroborative documentation is needed. Using the NAIC Uniform Suspected Insurance Fraud Reporting Form, having ample evidence can greatly support the claim. Insurers look for consistent and compelling proof to justify investigations and potential claims denials. Therefore, being aware of the necessary documentation can help individuals prepare more effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.