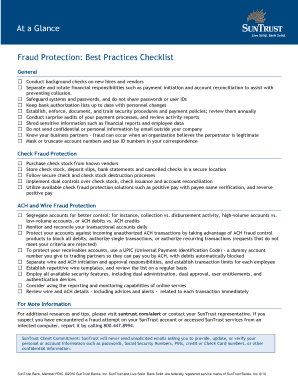

Get Fraud Protection: Best Practices Checklist

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fraud Protection: Best Practices Checklist online

The Fraud Protection: Best Practices Checklist is an essential tool designed to help organizations mitigate the risks associated with fraud. This guide provides clear, step-by-step instructions for completing the checklist online, ensuring that every user, regardless of experience, can effectively implement these best practices.

Follow the steps to complete the checklist with ease.

- Press the ‘Get Form’ button to obtain the checklist and open it in your preferred online editor.

- Begin with the general section, which outlines crucial practices such as conducting background checks on new hires and vendors. Ensure you check each item and follow your organizational protocols.

- In the check fraud protection section, review the recommended practices. Document how you will implement measures like purchasing check stock from known vendors and storing sensitive materials securely.

- Move to the ACH and wire fraud protection segment. Identify and note the segregation of accounts and the monitoring processes you will employ. Complete any related required fields.

- Verify that you have filled out all relevant sections completely, ensuring all security procedures and policies are documented in line with your organization's standards.

- Once you have completed the checklist, save your changes. You can choose to download, print, or share the filled-out form to your necessary stakeholders.

Start filling out the Fraud Protection: Best Practices Checklist online today to enhance your organization's security measures.

To manage fraud effectively, begin with assessing risks to determine where vulnerabilities lie. Next, establish and enforce fraud prevention policies, ensuring that employees understand their importance. Implement monitoring systems to detect unusual behavior and transaction patterns. Finally, engage in regular reviews to adapt your fraud protection measures, enhancing your best practices checklist in the process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.