Loading

Get F??????l??pj ?????? ????? ???? ?? ???????? ??? L?? ??? ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the F??????l??pj ?????? ????? ???? ?? ???????? ??? L?? ??? ... online

Filling out the F??????l??pj ?????? ????? ???? ?? ???????? ??? L?? ??? ... online can be straightforward with the right guidance. This guide will provide you with step-by-step instructions for completing the form accurately and efficiently.

Follow the steps to successfully fill out the form online.

- Click the ‘Get Form’ button to obtain the form and access it in your designated online editor.

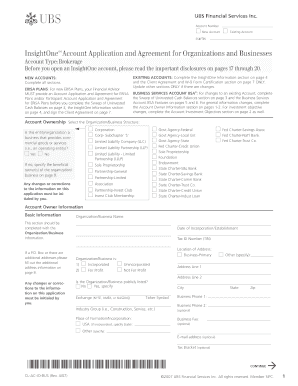

- Identify the type of account you are applying for: New Account or Existing Account, and select the appropriate option.

- Fill in your Account Number, SS#/TIN, and other personal information as required in the basic information section.

- For new accounts, ensure to complete all sections thoroughly, including any additional details specific to ERISA plans if applicable.

- If you have an existing account, complete only the InsightOne Information section and the Client Agreement sections that are necessary.

- Fill in the Account Owner Information section, specifying the Organization/Business Name, date of incorporation, and address details.

- Provide financial information such as annual income, net worth, and any loans outstanding in the Financial Information section.

- Complete the Principal Officer/Owner section with the required details for business owners or beneficial owners.

- Indicate your account investment objectives from the options provided, ensuring to select risk profiles that align with your investment strategy.

- Finally, review all details for accuracy, sign where necessary, and ensure any additional sections are completed as needed.

- Once completed, save changes, download the document for your records, and print or share it as required.

Complete your F??????l??pj ?????? ????? ???? ?? ???????? ??? L?? ??? ... online today for a smooth account setup.

Any partnership that operates in Florida is required to file a tax return, regardless of whether the partnership is in profit or loss. This includes general partnerships and limited liability companies taxed as partnerships. If you're unsure about your partnership's obligations, the US Legal Forms platform is here to help you navigate the requirements with ease.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.